Add office photos

Employer?

Claim Account for FREE

CRED ![]()

3.5

based on 144 Reviews

Video summary

Company Overview

Company Locations

Working at CRED

Company Summary

Fintech company for reward-based credit card bill payments

Overall Rating

3.5/5

based on 144 reviews

5% below

industry average

Critically rated for

Promotions, Job security, Work-life balance

Work Policy

Work from office

58% employees reported

Monday to Friday

65% employees reported

Flexible timing

81% employees reported

No travel

71% employees reported

View detailed work policy

Top Employees Benefits

Free meal

8 employees reported

Health insurance

7 employees reported

Job/Soft skill training

4 employees reported

Cafeteria

3 employees reported

View all benefits

About CRED

Founded in2018 (7 yrs old)

India Employee Count201-500

Global Employee Count--

India HeadquartersBangalore,Karnataka, India

Office Locations

Websitecred.club

Primary Industry

Other Industries

Are you managing CRED 's employer brand? To edit company information,

claim this page for free

View in video summary

We're a team of creative, driven and persistent people. We want to create a community of the creditworthy. We want to re-imagine the ideal way of life that works on two way trust and respect. Every partnership, collaboration or idea we create works towards providing an experience beyond imagination. Every member is passionate towards this goal. This passion seamlessly drives us forward. If you have ideas, passion and courage, bring them to the table. Company culture to us stands at the forefront of what we believe in. We aim at finding unique people who will stand the test of time.

Report error

Managing your company's employer brand?

Claim this Company Page for FREE

CRED Ratings

based on 144 reviews

Overall Rating

3.5/5

How AmbitionBox ratings work?

5

52

4

43

3

15

2

11

1

23

Category Ratings

3.6

Company culture

3.6

Salary

3.5

Skill development

3.3

Work satisfaction

3.2

Work-life balance

3.1

Job security

2.9

Promotions

CRED is rated 3.5 out of 5 stars on AmbitionBox, based on 144 company reviews.This rating reflects an average employee experience, indicating moderate satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at CRED

based on 131 reviews

2.9

Rated by 35 Women

Rated 3.3 for Skill development and 3.2 for Salary

3.8

Rated by 96 Men

Rated 3.9 for Company culture and 3.7 for Salary

Work Policy at CRED

based on 26 reviews in last 6 months

Work from office

58%

Hybrid

38%

Permanent work from home

4%

CRED Reviews

Top mentions in CRED Reviews

+ 5 more

Compare CRED with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 3.5/5 based on 144 reviews | 4.1/5 based on 263 reviews | 3.5/5 based on 220 reviews | 3.5/5 based on 208 reviews |

Highly Rated for |  No highly rated category | Work-life balance Company culture Job security |  No highly rated category |  No highly rated category |

Critically Rated for | Promotions Job security Work-life balance |  No critically rated category | Job security Skill development Promotions | Job security Promotions Work satisfaction |

Primary Work Policy | Work from office 58% employees reported | Hybrid 58% employees reported | Work from office 66% employees reported | Work from office 71% employees reported |

Rating by Women Employees | 2.9 Poor rated by 35 women | 4.2 Good rated by 70 women | 3.4 Average rated by 31 women | 3.0 Average rated by 43 women |

Rating by Men Employees | 3.8 Good rated by 96 men | 4.1 Good rated by 186 men | 3.6 Good rated by 180 men | 3.6 Good rated by 147 men |

Job security | 3.1 Average | 4.0 Good | 2.9 Poor | 2.9 Poor |

View more

CRED Salaries

CRED salaries have received with an average score of 3.6 out of 5 by 144 employees.

Software Engineer

(72 salaries)

Unlock

₹26.3 L/yr - ₹53.9 L/yr

Product Manager

(53 salaries)

Unlock

₹22.5 L/yr - ₹41 L/yr

Senior Wealth Manager

(37 salaries)

Unlock

₹23.8 L/yr - ₹37.8 L/yr

Software Developer

(36 salaries)

Unlock

₹22.2 L/yr - ₹38.1 L/yr

Senior Software Engineer

(26 salaries)

Unlock

₹26 L/yr - ₹62.5 L/yr

Backend Developer

(24 salaries)

Unlock

₹25.4 L/yr - ₹46.8 L/yr

Senior Product Manager

(21 salaries)

Unlock

₹37.3 L/yr - ₹60 L/yr

Data Scientist

(19 salaries)

Unlock

₹18.2 L/yr - ₹34 L/yr

AVP & Branch Head

(18 salaries)

Unlock

₹22 L/yr - ₹25 L/yr

SDE (Software Development Engineer)

(18 salaries)

Unlock

₹14.9 L/yr - ₹26 L/yr

CRED Interview Questions

CRED Jobs

Popular Skills CRED Hires for

Current Openings

CRED News

View all

Beyond The Top Apps: Will MDR On UPI Lift CRED, Navi, Groww And Others?

- MDR on UPI transactions may boost revenue for high-volume payment apps.

- PCI has proposed MDR for transactions above INR 2,000 by 'large merchants'.

- Top apps like CRED, Groww positioned to benefit due to high transaction value.

- Small UPI apps with low average ticket sizes might be left out initially.

- MDR implementation could impact UPI app landscape and potential revenue streams.

Inc42 | 15 Jul, 2025

Joyce Shen’s picks: musings and readings in AI/ML, July 7, 2025

- Google makes a significant investment in fusion technology with a 200 MW deal.

- A study uncovers AI patterns in millions of scientific papers, indicating AI's influence on research.

- Several AI startups secure substantial financing, including RevEng.ai, Audos, LogicFlo, North.Cloud, CRED, Enquire AI, Argon AI, Civ Robotics, Genesis AI, and Wonderful.

- EU reaffirms commitment to implementing AI legislation according to schedule.

Medium | 7 Jul, 2025

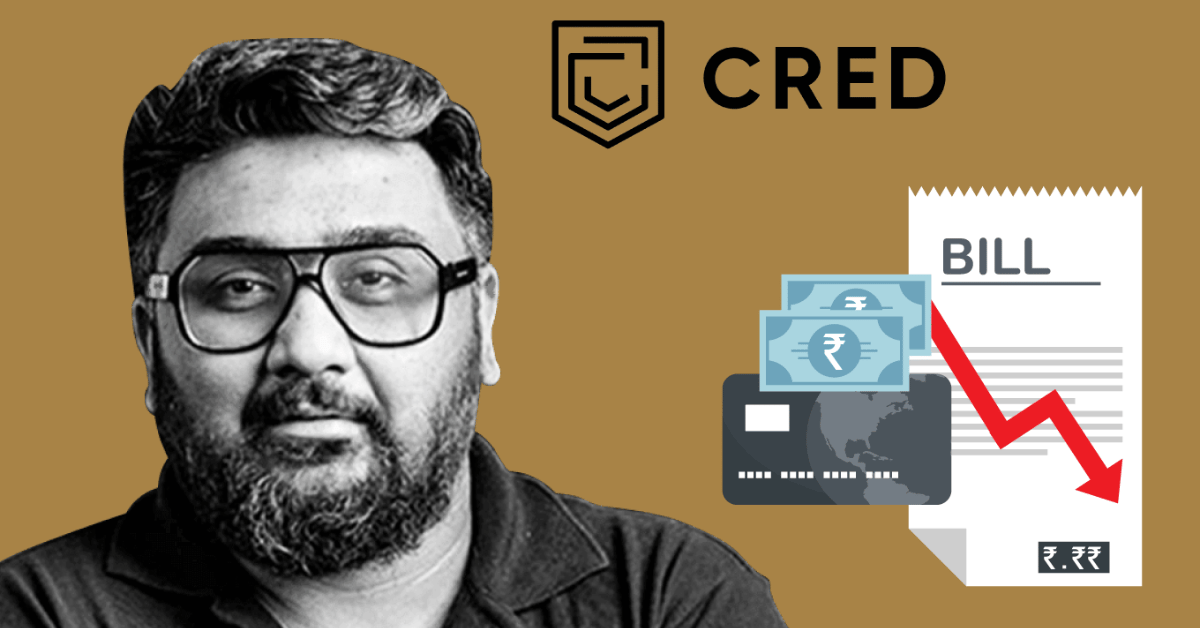

'Rs 5,215 crore in losses, no profitable year, so why do we celebrate Kunal Shah?': Deloitte consultant

- Deloitte Senior Consultant Adarsh Samalopanan questioned the celebration of Kunal Shah's entrepreneurial journey due to continuous losses and lack of profitability over his 15-year career.

- Kunal Shah co-founded Freecharge in 2010, which incurred significant losses despite being acquired by Snapdeal for Rs 2,800 crore and later purchased by Axis Bank for Rs 370 crore, a fraction of its earlier valuation.

- Shah's current venture, CRED, has amassed Rs 5,215 crore in losses with Rs 493 crore cumulative revenue over seven years, spurring debates on the celebration of unprofitable ventures and inflated valuations.

- Reactions to Adarsh's post varied, with some defending Shah's market-changing impact in digital payments and premium credit experiences, while others questioned the valuation metrics and profitability of such ventures.

ISN | 5 Jul, 2025

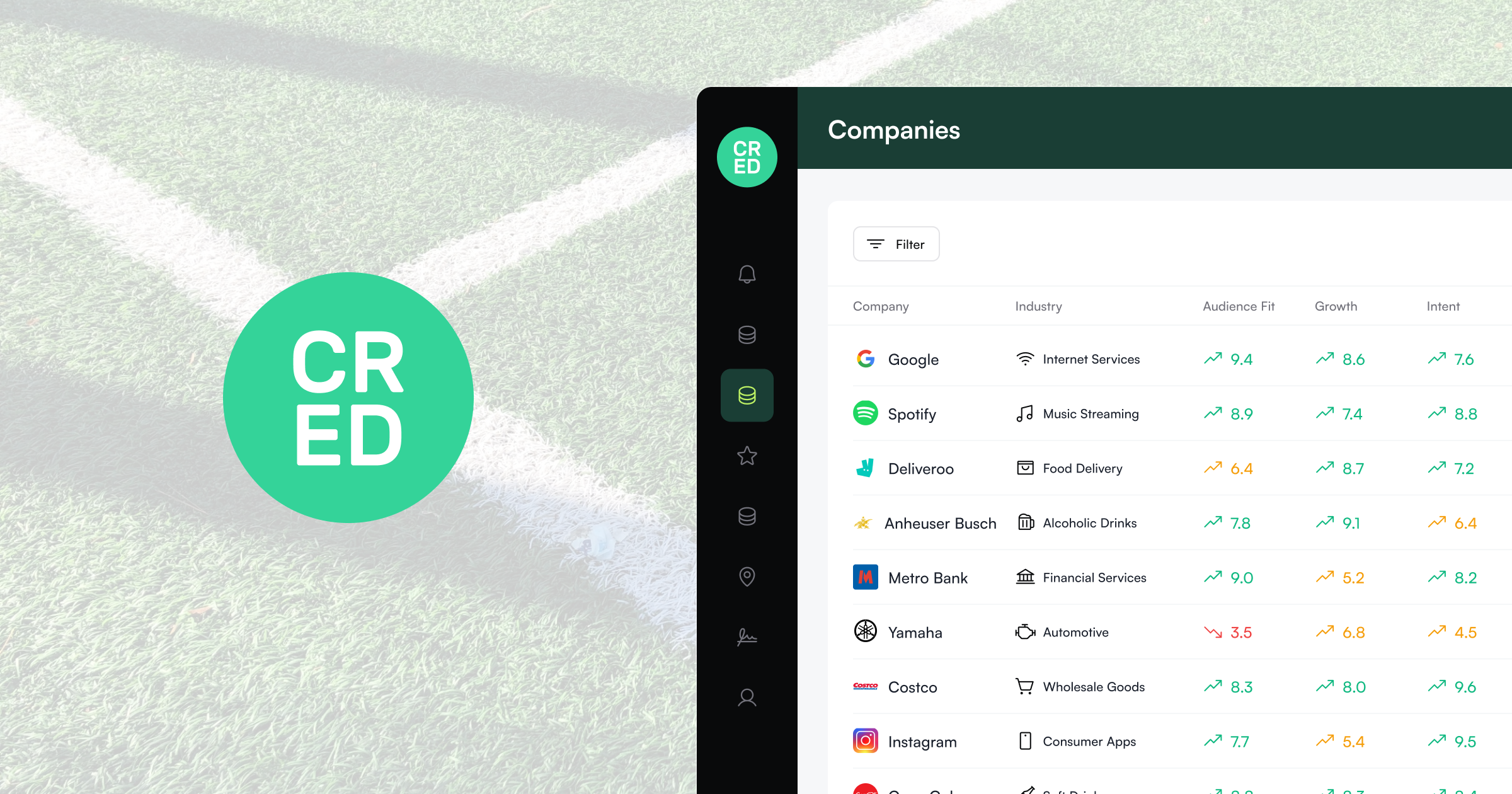

CRED launches with $15M to bring predictive AI to enterprise teams

- CRED, an artificial intelligence-powered predictive intelligence platform startup, has launched with $15 million in funding to accelerate product development, scale operations, and grow the team.

- CRED's platform integrates internal business systems with real-time external market data to deliver contextualized insights and intelligent recommendations tailored to each use case.

- The platform audits and enriches enterprise data in real time, utilizes predictive scoring models for assessing prospects, and sends real-time alerts to go-to-market teams based on key signals detected.

- The predictive intelligence engine has already generated over $100 million in revenue for users in the last year with more than $20 million in cost savings. The seed round was led by defy.vc with other prominent investors participating.

Siliconangle | 1 Jul, 2025

Countries with low financial independence for women have lower divorce rates, not for happy marriages: Kunal Shah

- Kunal Shah, CRED founder, highlighted the low female participation in India's labor force.

- Shah emphasized the importance of financial independence for women, stating it impacts social dynamics.

- He pointed out that countries with low financial independence for women often have lower divorce rates, not necessarily reflecting happy marriages.

- Shah stressed that India won't prosper with one gender dominating the workforce.

- The article addresses the significance of gender equality for economic growth and social well-being.

Startup Pedia | 29 Jun, 2025

“In India, people making ₹10,000 an hour will spend an hour to save ₹500 on a flight," says CRED's Kunal Shah

- CRED founder Kunal Shah highlighted Indians' tendency to waste money to save small amounts, emphasizing a lack of understanding of time value.

- Shah noted the disparity in how Indians and Americans perceive the value of time, with Indians often making poor time-related decisions.

- He mentioned the importance of time value for money, stating that many Indians do not grasp this concept effectively.

- Kunal Shah, an entrepreneur and angel investor involved with FreeCharge and CRED, commented on workforce participation issues in India, emphasizing the economic and social impact.

Startup Pedia | 28 Jun, 2025

ETtech Deals Digest: Indian startups raise $160 million this week, up 75% on-year

- Indian startups raised $160.3 million during June 7-13, a 74.7% increase from last year.

- The funding total also went up by 12.4% from the previous week's $142.7 million.

- Despite the higher funding, only 16 deals were recorded, less than half compared to last year's 34 transactions.

- Top deals included Cred securing $72 million, Flexiloans raising $43.8 million, and Vecmocon Technologies obtaining $18 million.

- Cred's valuation dropped to $3.5 billion from $6.4 billion in the recent round led by GIC.

- Flexiloans' round was backed by investors like Nandan Nilekani's Fundamentum and Accion Digital Transformation.

- Vecmocon Technologies' $18 million funding round was led by Ecosystem Integrity Fund.

- Deal activity remained subdued despite the increased funding amounts.

- The number of transactions this week stood at 16, showing a decline from the same period last year.

- Indian startup funding continues to show resilience and investor interest.

- Startups across various sectors are attracting investments from both domestic and international players.

- The overall funding climate remains positive for Indian startups, albeit with fluctuations in deal activity.

- Fintech, NBFC, and Deeptech startups were among the key sectors that received significant funding during the week.

- Investors are closely watching the developments in the Indian startup ecosystem amidst changing valuations and market conditions.

- The funding landscape for startups reflects the evolving trends and challenges in the Indian entrepreneurial ecosystem.

Economic Times | 13 Jun, 2025

Exclusive: On-Demand Salary Startup Refyne Bags INR 35 Cr Debt

- Fintech startup Refyne, offering on-demand salary access, secures INR 35 Cr debt from Stride Ventures.

- Refyne to issue 3,500 Series A debentures at INR 1 Lakh each according to MCA filing.

- The capital will be used for working capital and general corporate purposes.

- Refyne allows employees to access earned salaries on-demand through its platform.

- The startup caters to over 1 Cr employees from 500+ companies in India.

- Refyne charges a convenience fee when employees withdraw funds and offers loans with interest.

- It secured $82 Mn in Series B funding led by Tiger Global and has raised over $100 Mn to date.

- Refyne competes with multiple players in the EWA and lending tech space in India.

- The company reported a 27% decrease in net loss in FY24 and revenue surged by 59%.

- The lending tech market in India is booming with a projected $2.1 Tn market opportunity by 2030.

- Startups like CRED and Fibe have recently raised significant funds in the lending space.

Inc42 | 11 Jun, 2025

CRED Raises $72 Mn In A Down Round From GIC, Others

- Fintech unicorn CRED raised $72 Mn in a down round led by GIC’s Lathe Investment.

- The funding round valued CRED at $3.5 Bn, a 45% decrease from its last valuation of $6.4 Bn in 2022.

- GIC, RTP Capital, Sofina, and QED Innovation Labs were among the major investors in the Series G round.

- CRED, aiming for a potential IPO in the next two years, has been expanding its offerings despite increasing losses and a rise in revenue.

Inc42 | 10 Jun, 2025

Fintech start-up CRED to raise $75 m in funding round led by existing investors

- Fintech start-up CRED is set to raise $75 million in funding led by existing investors for scaling its credit card business and exploring new business opportunities.

- This funding round will lower CRED's valuation to about $3.5 billion, a 45% decrease from its previous valuation in 2022, where it was valued at $6.5 billion. The last funding round of $140 million was led by GIC in the same year.

- CRED recently introduced an e-rupee (e₹) wallet in partnership with RBI as the first fintech to integrate the central bank's digital currency. It also collaborated with CARS24 and Spinny for car selling services on its platform.

- In FY24, CRED reported a revenue of ₹2,473 crore, marking a 66% increase driven by product adoption and user growth. The operational loss was reduced by 41% to ₹609 crore.

HinduBusinessLine | 28 May, 2025

Powered by

Compare CRED with

Paytm

3.2

BharatPe

3.5

Uni Cards

3.9

indiagold

4.2

Open Financial Technologies Private Limited

3.2

OneCard

3.4

Eduvanz

3.6

Cashfree Payments

3.3

EarlySalary Services

3.7

Payswiff Solutions

4.1

PolicyX.com

2.9

ZestMoney

4.0

Jodo

3.5

Namaste Credit

3.4

MAYBRIGHT VENTURES PRIVATE LIMITED, Kolkata

3.3

Drip Capital

3.7

Affordplan

3.7

Jupiter Money

3.0

CreditVidya

3.7

INDMoney

3.4

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Companies Similar to CRED

Money View

Internet, FinTech

4.1

• 263 reviews

Ocrolus East

Internet, FinTech

3.5

• 220 reviews

indiagold

Financial Services, FinTech

4.2

• 176 reviews

3.2

• 171 reviews

Cashfree Payments

Financial Services, FinTech

3.3

• 155 reviews

EarlySalary Services

FinTech, NBFC

3.7

• 147 reviews

Payswiff Solutions

Financial Services, Internet, FinTech

4.1

• 145 reviews

PolicyX.com

Financial Services, FinTech

2.9

• 134 reviews

CRED FAQs

When was CRED founded?

CRED was founded in 2018. The company has been operating for 7 years primarily in the FinTech sector.

Where is the CRED headquarters located?

CRED is headquartered in Bangalore,Karnataka and has an office in Bangalore / Bengaluru.

How many employees does CRED have in India?

CRED currently has approximately 300+ employees in India.

Does CRED have good work-life balance?

CRED has a work-life balance rating of 3.2 out of 5 based on 100+ employee reviews on AmbitionBox. 34% employees rated CRED 3 or below, while 66% employees rated it 4 or above for work-life balance. This rating suggests that while some employees recognize efforts towards work-life balance, there is scope for improvement based on employee feedback. We encourage you to read CRED work-life balance reviews for more details.

Is CRED good for career growth?

Career growth at CRED is rated as poor, with a promotions and appraisal rating of 2.9. 34% employees rated CRED 3 or below on promotions / appraisal. This rating reflects a negative sentiment among employees for career growth. We recommend reading CRED promotions / appraisals reviews for more detailed insights.

What are the cons of working in CRED ?

Working at CRED does have some drawbacks that potential employees should consider. The company is poorly rated for promotions / appraisal, job security and work life balance, based on 100+ employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Trusted by over 1.5 Crore job seekers to find their right fit company

80 Lakh+

Reviews

10L+

Interviews

4 Crore+

Salaries

1.5 Cr+

Users

Contribute to help millions

AmbitionBox Awards

Get AmbitionBox app