Add office photos

Employer?

Claim Account for FREE

General Industrial Controls![]()

3.8

based on 153 Reviews

Video summary

Company Overview

Company Locations

Working at General Industrial Controls

Company Summary

Established in 1972, General Industrial Controls is a leading electronics company in Pune, India, that manufactures Industrial Controls, Industrial Controllers and Timing devices.

Overall Rating

3.8/5

based on 153 reviews

3% below

industry average

Critically rated for

Promotions

Work Policy

Work from office

84% employees reported

Monday to Saturday

37% employees reported

Flexible timing

68% employees reported

No travel

62% employees reported

View detailed work policy

Top Employees Benefits

Job/Soft skill training

4 employees reported

Health insurance

4 employees reported

Professional degree assistance

1 employee reported

Office cab/shuttle

1 employee reported

View all benefits

About General Industrial Controls

Founded in1972 (53 yrs old)

India Employee Count201-500

Global Employee Count201-500

India HeadquartersPune, India

Office Locations

--

Websitegicindia.com

Primary Industry

Other Industries

Are you managing General Industrial Controls's employer brand? To edit company information,

claim this page for free

View in video summary

Established in 1972, General Industrial Controls Private Limited (GIC) located in Pune, India, manufactures Process Control, Automation and Instrumentation products. GIC was the first company to launch time switches and timers in India.

What started as a small venture four decades back, is now a company that offers an array of world-class products. With a relentless focus on customer satisfaction, GIC has successfully innovated and continuously improved their capabilities to build a product portfolio that embodies finesse and excelled quality.

Our high-performance products for Process Control and Automation application, together with our ingenious tooling solutions, have garnered us an excellent reputation the world over.

Report error

Managing your company's employer brand?

Claim this Company Page for FREE

General Industrial Controls Ratings

based on 153 reviews

Overall Rating

3.8/5

How AmbitionBox ratings work?

5

58

4

38

3

37

2

9

1

11

Category Ratings

3.7

Job security

3.7

Skill development

3.6

Company culture

3.6

Work-life balance

3.6

Work satisfaction

3.5

Salary

3.2

Promotions

General Industrial Controls is rated 3.8 out of 5 stars on AmbitionBox, based on 153 company reviews.This rating reflects an average employee experience, indicating moderate satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at General Industrial Controls

based on 142 reviews

4.0

Rated by 17 Women

Rated 4.1 for Job security and 3.9 for Company culture

3.7

Rated by 125 Men

Rated 3.8 for Skill development and 3.6 for Company culture

Work Policy at General Industrial Controls

based on 24 reviews in last 6 months

Work from office

84%

Hybrid

16%

General Industrial Controls Reviews

Top mentions in General Industrial Controls Reviews

+ 5 more

Compare General Industrial Controls with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 3.8/5 based on 153 reviews | 4.6/5 based on 359 reviews | 3.3/5 based on 365 reviews | 3.8/5 based on 408 reviews |

Highly Rated for |  No highly rated category | Company culture Work-life balance Salary |  No highly rated category |  No highly rated category |

Critically Rated for | Promotions |  No critically rated category | Job security Promotions Skill development | Promotions Job security |

Primary Work Policy | Work from office 84% employees reported | Work from office 74% employees reported | Work from office 87% employees reported | Work from office 48% employees reported |

Rating by Women Employees | 4.0 Good rated by 17 women | - no rating available | 3.7 Good rated by 43 women | 3.8 Good rated by 32 women |

Rating by Men Employees | 3.7 Good rated by 125 men | - no rating available | 3.3 Average rated by 299 men | 3.7 Good rated by 354 men |

Job security | 3.7 Good | 4.4 Good | 2.9 Poor | 3.2 Average |

View more

General Industrial Controls Salaries

General Industrial Controls salaries have received with an average score of 3.5 out of 5 by 153 employees.

Quality Engineer

(42 salaries)

Unlock

₹2.4 L/yr - ₹6 L/yr

Senior Engineer

(27 salaries)

Unlock

₹4.5 L/yr - ₹9.5 L/yr

Team Lead

(19 salaries)

Unlock

₹5.3 L/yr - ₹12 L/yr

Junior Engineer

(17 salaries)

Unlock

₹3.3 L/yr - ₹5.3 L/yr

Graduate Engineer Trainee (Get)

(12 salaries)

Unlock

₹2.8 L/yr - ₹4 L/yr

Design Engineer

(12 salaries)

Unlock

₹3.3 L/yr - ₹7 L/yr

Production Supervisor

(12 salaries)

Unlock

₹3.1 L/yr - ₹5.8 L/yr

Trainee

(12 salaries)

Unlock

₹1.1 L/yr - ₹3.2 L/yr

Senior Production Supervisor

(12 salaries)

Unlock

₹4.5 L/yr - ₹6.8 L/yr

Sales Engineer

(10 salaries)

Unlock

₹4.2 L/yr - ₹6.5 L/yr

General Industrial Controls Interview Questions

General Industrial Controls Jobs

Popular Designations General Industrial Controls Hires for

Program Manager

Create job alerts

Quality Engineer

Create job alerts

Popular Skills General Industrial Controls Hires for

Current Openings

General Industrial Controls News

View all

CCI Approves GIC’s Investment In IPO-Bound Groww

- CCI has approved Singapore sovereign fund GIC's stake acquisition in fintech unicorn Groww ahead of its IPO.

- GIC Ventures' subsidiary, Viggo Investment, is set to acquire a 2.14% stake in Groww after seeking CCI approval in May.

- Groww recently closed a funding round, raising $202.3 Mn from GIC and ICONIQ Capital, valuing the company at $7 Bn.

- Groww has filed its draft red herring prospectus (DRHP) with SEBI after the funding round, with its IPO expected to be around $700 Mn to $1 Bn.

Inc42 | 1 Jul, 2025

Kalpataru makes muted debut, trades 3.86% above issue price amid debt concerns

- Kalpataru made a muted debut despite oversubscription of its IPO 2.26 times, trading 3.86% above the issue price.

- The company raised ₹708 crore from nine anchor investors, including significant investments from GIC, Bain Capital, and other marquee investors.

- Analysts express concerns about Kalpataru's high debt of over ₹11,000 crore against a market capitalization of ₹8,500 crore, despite generating revenue of ₹1,930 crore in FY24.

- The company, operating in Mumbai Metropolitan Region and Pune, intends to use IPO proceeds for debt repayment among its 40 ongoing projects.

HinduBusinessLine | 1 Jul, 2025

Kalpataru IPO subscribed 9% on Day 1

- Kalpataru Limited launched its IPO with a price band of ₹387-414, aiming to raise ₹1,590 crore through a fresh issue.

- The Bid/Issue Closing Date is set for June 26, with a minimum bid of 36 Equity Shares and multiples of 36 thereafter.

- NIIs and retail quotas were subscribed 0.10 times and 0.33 times, respectively, with the employee quota at 0.18 times.

- The net proceeds from the IPO will be used to repay borrowings and for general corporate purposes.

- Ahead of the IPO, Kalpataru raised ₹708 crore from anchor investors, including global and domestic institutions.

- GIC and Bain Capital were prominent anchor investors, along with SBI Mutual Fund and ICICI Prudential Mutual Fund.

- ICICI Securities, JM Financial, and Nomura Financial are the Book-Running Lead Managers for the IPO.

- Kalpataru Ltd. mainly focuses on luxury, premium, and mid-income real estate projects across Indian cities.

- The company plans to list its shares on the NSE and the BSE following the IPO.

- The IPO committee finalised 171,09,783 equity shares for anchor investors at ₹414 a share.

- The IPO received a 9% subscription on Day 1, with significant interest from institutional and retail investors.

- Kalpataru Ltd. was founded in 1988 and is part of the Kalpataru Group, with interests in construction and infra sectors.

HinduBusinessLine | 25 Jun, 2025

Kalpataru IPO opens today at Rs 387-414 price band

- Kalpataru IPO opens with a price band of Rs 387-414 per share for a fresh issue, aiming to raise ₹1,590 crore.

- Bids can be made for a minimum of 36 Equity Shares and in multiples of 36 Equity Shares thereafter.

- The Anchor Investor Bidding Date is one Working Day prior to Bid/Issue Opening Date.

- The Bid/Issue Closing Date is set for Thursday, June 26, 2025.

- Allocation of ₹171,09,783 equity shares to anchor investors at ₹414 a share, raising Rs 708 crore.

- GIC and Bain Capital are among the key anchor investors participating in the IPO.

- Net proceeds from the IPO will be used for repayment/pre-payment of borrowings and general corporate purposes.

- ICICI Securities, JM Financial, and Nomura Financial are the Book Running Lead Managers for the IPO.

- Kalpataru Ltd. focuses on luxury, premium, and mid-income residential projects, part of the Kalpataru Group founded in 1988.

HinduBusinessLine | 24 Jun, 2025

IPO-Bound Groww Reports 3X Surge in FY25 Profit, Raises $200M at $7B Valuation

- Bengaluru-based investment platform Groww saw a 3x increase in net profit to Rs 1,819 crore for FY25, along with a 31% YoY rise in revenue to Rs 4,056 crore.

- Groww secured $200 million in a Series F funding round at a $7 billion valuation, with GIC (Singapore) and ICONIQ Capital participating.

- It recently filed confidential IPO papers with SEBI and is looking at a public issue worth $700 million to $1 billion.

- Founded in 2016, Groww has become India's largest stockbroking platform by active clients, boasting a 26.32% market share.

- The company has expanded into digital lending, wealth advisory, and mutual fund management through acquisitions like Fisdom and Indiabulls AMC.

- Groww's financial success in FY25 follows a significant net loss of Rs 805 crore in FY24 due to a one-time tax payment related to re-domiciling.

- With an upcoming IPO and strong financial performance, Groww is poised to be a highly anticipated listing in India's fintech sector.

Startup Story | 13 Jun, 2025

ETtech Deals Digest: Indian startups raise $160 million this week, up 75% on-year

- Indian startups raised $160.3 million during June 7-13, a 74.7% increase from last year.

- The funding total also went up by 12.4% from the previous week's $142.7 million.

- Despite the higher funding, only 16 deals were recorded, less than half compared to last year's 34 transactions.

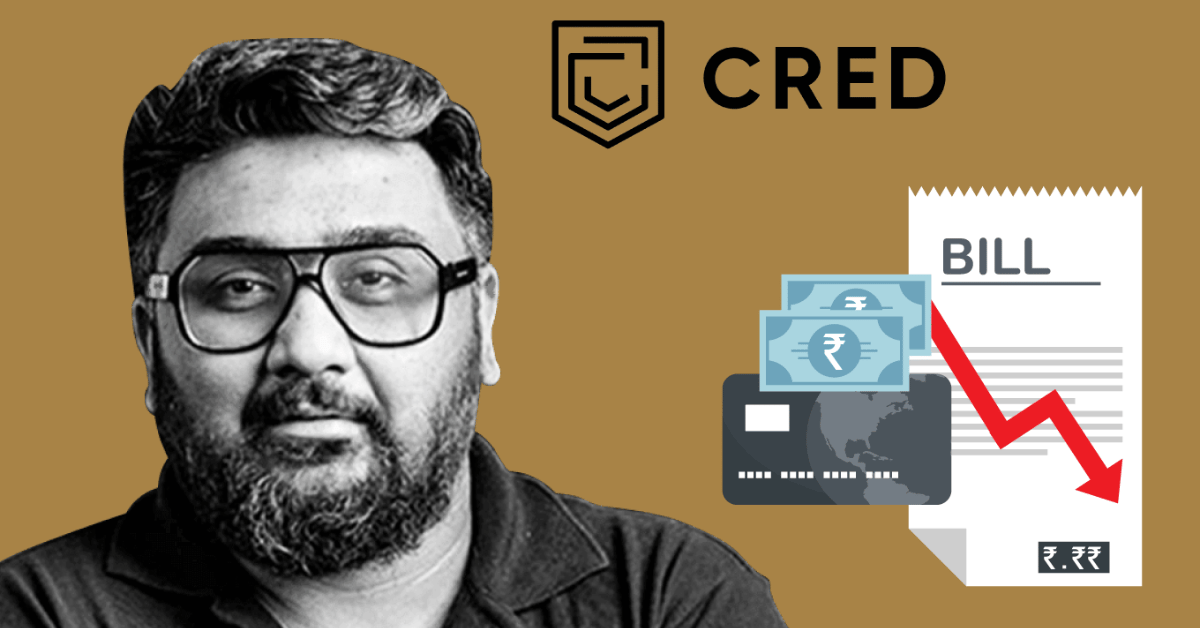

- Top deals included Cred securing $72 million, Flexiloans raising $43.8 million, and Vecmocon Technologies obtaining $18 million.

- Cred's valuation dropped to $3.5 billion from $6.4 billion in the recent round led by GIC.

- Flexiloans' round was backed by investors like Nandan Nilekani's Fundamentum and Accion Digital Transformation.

- Vecmocon Technologies' $18 million funding round was led by Ecosystem Integrity Fund.

- Deal activity remained subdued despite the increased funding amounts.

- The number of transactions this week stood at 16, showing a decline from the same period last year.

- Indian startup funding continues to show resilience and investor interest.

- Startups across various sectors are attracting investments from both domestic and international players.

- The overall funding climate remains positive for Indian startups, albeit with fluctuations in deal activity.

- Fintech, NBFC, and Deeptech startups were among the key sectors that received significant funding during the week.

- Investors are closely watching the developments in the Indian startup ecosystem amidst changing valuations and market conditions.

- The funding landscape for startups reflects the evolving trends and challenges in the Indian entrepreneurial ecosystem.

Economic Times | 13 Jun, 2025

Groww Closes $200 Mn Funding Round Ahead Of IPO

- Wealthtech startup Groww has closed a Series F funding round of $202.3 Mn from GIC and ICONIQ Capital at a $7 Bn valuation.

- The Bengaluru-based unicorn has seen a 250% valuation jump.

- The funding round comes after reports of the startup planning to raise funds before its public listing.

- The startup approved the allotment of Series F CCPS to GIC and ICONIQ Capital.

- Groww has diluted 2.86% equity shares on conversion of the preference shares.

- The new funds are for the growth of its business and subsidiaries.

- Founded in 2017, Groww is an online discount broking platform.

- Despite reporting a net loss of INR 805 Cr in FY24, Groww's total revenue surged by 119%.

- Groww filed its DRHP with SEBI last month for an IPO.

- The startup aims to raise $700 Mn to $1 Bn and seeks a valuation of $8 Bn to $7 Bn.

- Groww's IPO is expected to have a larger OFS component and a small fresh issues portion.

- Recently, Groww completed the acquisition of Fisdom and launched a new fund offer.

- The startup settled cases with SEBI for misconduct and technical glitches.

- Groww's IPO journey and recent developments mark significant milestones.

- The funding round positions Groww for its impending IPO.

- The startup has seen both challenges and achievements leading up to its IPO.

- The funding and developments indicate a dynamic phase for Groww in the wealthtech sector.

Inc42 | 13 Jun, 2025

CRED Raises $72 Mn In A Down Round From GIC, Others

- Fintech unicorn CRED raised $72 Mn in a down round led by GIC’s Lathe Investment.

- The funding round valued CRED at $3.5 Bn, a 45% decrease from its last valuation of $6.4 Bn in 2022.

- GIC, RTP Capital, Sofina, and QED Innovation Labs were among the major investors in the Series G round.

- CRED, aiming for a potential IPO in the next two years, has been expanding its offerings despite increasing losses and a rise in revenue.

Inc42 | 10 Jun, 2025

Groww To Raise $202 Mn From GIC, ICONIQ Ahead Of IPO

- IPO-bound fintech unicorn Groww is set to raise $202.3 Mn in a Series F funding round from GIC and ICONIQ Capital.

- This funding will involve allotment of Series F compulsorily convertible preference shares to Singapore GIC and ICONIQ Capital-linked ISP VII-B Blocker GW.

- Groww filed its draft red herring prospectus with the SEBI for an IPO to raise between $700 Mn and $1 Bn.

- The company has been active in acquiring startups like Fisdom and expanding its offerings in preparation for its IPO debut with a conservative valuation of $7 Bn.

Inc42 | 6 Jun, 2025

Profitable African fintech PalmPay is in talks to raise as much as $100M

- African digital bank fintech, PalmPay, is in talks to raise between $50 million and $100 million in a Series B round for further expansion.

- PalmPay, launched in 2019, is now profitable, with $140 million raised across seed and Series A rounds, aiming to deepen its footprint in Nigeria and introduce its offerings in new markets.

- PalmPay has reported significant growth, hitting 15 million daily transactions with revenue surging to $64 million in 2023, more than doubling since then.

- The company's partnership with Transsion, a leading phone maker in Africa, and investors like GIC and Mediatek, contribute to its widespread adoption and plans for international expansion.

TechCrunch | 5 Jun, 2025

Powered by

Compare General Industrial Controls with

Gilbarco Veeder Root

3.8

HYT Engineering Company Pvt Ltd

3.3

Kirloskar Toyota Textile Machinery

4.6

L&T–MHI Power Boilers

3.9

Hyundai Construction Equipment

4.3

Veer-O-- Metals

4.2

Toyota Material Handling

3.7

Diffusion Engineers

4.1

Toshiba

4.1

Super Auto Forge

4.0

Parason Machinery

3.5

Kobelco Construction Equipment India

4.3

Beri Udyog

4.0

Beumer Group

3.8

Bosch Power Tools

4.2

Mvs Acmei Technologies

4.0

Putzmeister Concrete Machines

3.5

Tecumseh Products

3.4

Stumpp Schuele & Somappa Springs

3.4

Sadhu Forging

3.6

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Companies Similar to General Industrial Controls

Gilbarco Veeder Root

Industrial Machinery, Oil / Gas / Petro Chemicals

3.8

• 408 reviews

HYT Engineering Company Pvt Ltd

Industrial Machinery, Engineering & Construction

3.3

• 365 reviews

Kirloskar Toyota Textile Machinery

Industrial Machinery, Fashion & Textile

4.6

• 359 reviews

L&T–MHI Power Boilers

Industrial Machinery, Manufacturing, Engineering & Construction

3.9

• 308 reviews

Hyundai Construction Equipment

Industrial Machinery, Manufacturing

4.3

• 297 reviews

Veer-O-- Metals

Industrial Machinery, Metals & Mining

4.2

• 252 reviews

Toyota Material Handling

Import & Export, Industrial Machinery

3.7

• 252 reviews

Diffusion Engineers

Industrial Machinery

4.1

• 238 reviews

Toshiba

Industrial Machinery, Manufacturing, Electronics

4.1

• 232 reviews

Super Auto Forge

Iron & Steel, Industrial Machinery

4.0

• 229 reviews

Parason Machinery

Industrial Machinery

3.5

• 209 reviews

Kobelco Construction Equipment India

Industrial Machinery

4.3

• 204 reviews

General Industrial Controls FAQs

When was General Industrial Controls founded?

General Industrial Controls was founded in 1972. The company has been operating for 53 years primarily in the Industrial Machinery sector.

Where is the General Industrial Controls headquarters located?

General Industrial Controls is headquartered in Pune.

How many employees does General Industrial Controls have in India?

General Industrial Controls currently has approximately 200+ employees in India.

Does General Industrial Controls have good work-life balance?

General Industrial Controls has a Work-Life Balance Rating of 3.6 out of 5 based on 100+ employee reviews on AmbitionBox. 63% employees rated General Industrial Controls 4 or above, while 37% employees rated it 3 or below on work-life balance. This indicates that the majority of employees feel a generally balanced work-life experience, with some opportunities for improvement based on the feedback. We encourage you to read General Industrial Controls work-life balance reviews for more details.

Is General Industrial Controls good for career growth?

Career growth at General Industrial Controls is rated as moderate, with a promotions and appraisal rating of 3.2. 37% employees rated General Industrial Controls 3 or below, while 63% employees rated it 4 or above on promotions / appraisal. This rating suggests that while some employees view growth opportunities favorably, there is scope for improvement based on employee feedback. We recommend reading General Industrial Controls reviews for more detailed insights.

What are the cons of working in General Industrial Controls?

Working at General Industrial Controls does have some drawbacks that potential employees should consider. The company is poorly rated for promotions / appraisal, salary & benefits and work satisfaction, based on 100+ employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Trusted by over 1.5 Crore job seekers to find their right fit company

85 Lakh+

Reviews

10L+

Interviews

4 Crore+

Salaries

1.5 Cr+

Users

Contribute to help millions

AmbitionBox Awards

Get AmbitionBox app