Add office photos

Engaged Employer

Reliance Industries ![]()

4.0

based on 17.4k Reviews

Video summary

Proud winner of ABECA 2025 - AmbitionBox Employee Choice Awards

Company Overview

Associated Companies

Company Locations

Working at Reliance Industries

Company Summary

Reliance Industries is a major contributor to India's economy, driving large-scale initiatives and innovations to enhance stakeholder value and national growth.

Overall Rating

4.0/5

based on 17.4k reviews

3% above

industry average

Highly rated for

Job security, Skill development, Work-life balance

Critically rated for

Promotions

Work Policy

Work from office

79% employees reported

Monday to Saturday

47% employees reported

Flexible timing

52% employees reported

No travel

44% employees reported

View detailed work policy

Top Employees Benefits

Job/Soft skill training

1.2k employees reported

Health insurance

1.1k employees reported

Office cab/shuttle

835 employees reported

Cafeteria

478 employees reported

View all benefits

About Reliance Industries

Founded in1977 (48 yrs old)

India Employee Count1 Lakh+

Global Employee Count1 Lakh+

India HeadquartersNavi Mumbai, Maharashtra, India

Office Locations

Websiteril.com

Primary Industry

Other Industries

View in video summary

Reliance Industries Limited (RIL) is a Fortune 100 company and the largest private sector corporation in India. In just over four decades, we have emerged as one of India’s most valuable, stakeholder-centric organizations, building important assets for India and innovating for a better future for all Indians. We are one of the highest contributors to India's economic growth.

The legacy of Reliance has been shaped by an ability to think big. If you are someone who thrives on going beyond the status quo, if you are up for challenges in large-scale initiatives and aspire to be part of extraordinary teams playing key roles in strengthening the country’s economic growth, then Reliance is likely to have an opportunity for you!

The legacy of Reliance has been shaped by an ability to think big. If you are someone who thrives on going beyond the status quo, if you are up for challenges in large-scale initiatives and aspire to be part of extraordinary teams playing key roles in strengthening the country’s economic growth, then Reliance is likely to have an opportunity for you!

Report error

ABECA - AmbitionBox Employee Choice Awards

Awards 2025

Awards 2024

Best of the best, rated by employees

Reliance Industries won India’s Largest Employee Choice Awards in Mega Companies Category.

Top Rated Mega Company

Top Rated Energy & Power Company

Share

Reliance Industries Ratings

based on 17.4k reviews

Overall Rating

4.0/5

How AmbitionBox ratings work?

5

8.9k

4

4.2k

3

2.1k

2

806

1

1.3k

Category Ratings

4.1

Job security

4.0

Skill development

3.9

Work-life balance

3.8

Company culture

3.8

Work satisfaction

3.7

Salary

3.3

Promotions

Reliance Industries is rated 4.0 out of 5 stars on AmbitionBox, based on 17.4k company reviews. This rating reflects a generally positive employee experience, indicating satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at Reliance Industries

based on 16.4k reviews

3.8

Rated by 1.2k Women

Rated 3.9 for Job security and 3.7 for Work-life balance

4.0

Rated by 15.2k Men

Rated 4.1 for Job security and 4.0 for Skill development

Work Policy at Reliance Industries

based on 2.6k reviews in last 6 months

Work from office

79%

Hybrid

14%

Permanent work from home

7%

Reliance Industries Reviews

Top mentions in Reliance Industries Reviews

+ 5 more

Compare Reliance Industries with Similar Companies

Change Company | Change Company | Change Company | ||

|---|---|---|---|---|

Overall Rating | 4.0/5 based on 17.4k reviews | 4.0/5 based on 2.4k reviews | 4.1/5 based on 1.8k reviews | 4.4/5 based on 3.2k reviews |

Highly Rated for | Job security Skill development Work-life balance | Work-life balance Company culture Salary | Skill development Work-life balance Salary | Skill development Work-life balance Job security |

Critically Rated for | Promotions | Promotions | No critically rated category | No critically rated category |

Primary Work Policy | Work from office 79% employees reported | Hybrid 81% employees reported | Work from office 80% employees reported | Work from office 76% employees reported |

Rating by Women Employees | 3.8 Good rated by 1.2k women | 4.0 Good rated by 494 women | 4.2 Good rated by 175 women | 4.6 Excellent rated by 277 women |

Rating by Men Employees | 4.0 Good rated by 15.2k men | 4.0 Good rated by 1.7k men | 4.1 Good rated by 1.5k men | 4.4 Good rated by 2.6k men |

Job security | 4.1 Good | 3.4 Average | 3.8 Good | 4.2 Good |

View more

Reliance Industries Salaries

Reliance Industries salaries have received with an average score of 3.7 out of 5 by 17.4k employees.

Field Executive

(2.8k salaries)

Unlock

₹1.8 L/yr - ₹9.5 L/yr

Deputy Manager

(1.2k salaries)

Unlock

₹3.8 L/yr - ₹14 L/yr

Deputy General Manager

(635 salaries)

Unlock

₹12 L/yr - ₹45 L/yr

Graduate Engineer Trainee (Get)

(629 salaries)

Unlock

₹3 L/yr - ₹9 L/yr

Mechanical Maintenance Engineer

(600 salaries)

Unlock

₹3.1 L/yr - ₹12.6 L/yr

Shift Engineer

(566 salaries)

Unlock

₹4 L/yr - ₹12.5 L/yr

General Manager

(540 salaries)

Unlock

₹15 L/yr - ₹60 L/yr

Maintenance Engineer

(534 salaries)

Unlock

₹3.8 L/yr - ₹12.8 L/yr

Electrical Engineer

(489 salaries)

Unlock

₹2 L/yr - ₹10.9 L/yr

Panel Officer

(484 salaries)

Unlock

₹3.8 L/yr - ₹11.8 L/yr

Reliance Industries Interview Questions

A Graduate Engineer Trainee (Get) was asked 5mo agoQ. Explain the design process of a distillation column.

A Field Executive was asked 5mo agoQ. Which chemicals have you handled?

A Senior Executive was asked Q. What is the voltage of a telecom tower?

A Manager was asked 2mo agoQ. What is the best competitive programming (CP) practice or platform?

A Senior Manager was asked 3mo agoQ. What will you do after the failure of a PSV?

Reliance Industries Jobs

Current Openings

Reliance Industries News

View all

Reliance Ind scions Akash, Anant, Isha top wealth creators list, surpass father in personal wealth

- Isha Ambani ranks third on the wealth creators list with ₹3.58 lakh crore, followed by Adani brothers with assets of ₹2.72 lakh crore, ₹2.48 lakh crore, and ₹2.16 lakh crore.

- Mukesh Ambani is ranked 348 with personal wealth of ₹4,730 crore according to the 360 ONE Wealth report in partnership with Crisil Intelligence.

- The list includes 2,013 wealth creators with a combined net worth of about ₹100 lakh crore, equivalent to one-third of the country’s GDP.

- About 161 individuals have a net worth over ₹10,000 crore, while 169 individuals fall in the range of ₹5,000 crore to ₹10,000 crore.

- Family members and promoters from Tata Group, Reliance Industries, and Adani Group collectively hold 24% of promoter wealth estimated at ₹36 lakh crore.

- The top 50 business houses account for 59% of the overall wealth on the 360 ONE Wealth Creators List, with Reliance Industries and Adani Enterprises controlling 12% of total wealth.

- An additional ₹50 lakh crore of wealth in trusts and corporate entities, beyond the ₹100-lakh crore net worth, is held in promoter holdings.

- One-third of the total wealth is held through trusts and other entities, with Sir Dorabji Tata Trust and Sir Ratan Tata Trust emerging as the largest trusts holding about ₹8.2 lakh crore cumulatively.

- The median wealth of men is ₹1,475 crore, which is 22% higher than women whose median wealth is at ₹1,215 crore.

- The study suggests that women who have inherited wealth are 23% richer than their male counterparts with a net worth of ₹10,000 crore.

- India's first-generation entrepreneurs under 40 have acquired wealth by leveraging the digital economy, with 60% of their wealth coming from sectors including broking and investment platforms, e-commerce solutions, edtech, and fintech.

- The wealth report was published on June 17, 2025.

HinduBusinessLine | 17 Jun, 2025

Watch out for these stocks: Zee, PNB, ICICI Bank, Macrotech Developers, Biocon, Vishal Mega Mart, Bata, SIL, Marine Electrical

- Zee Entertainment plans to raise ₹2,237.44 crore through convertible warrants, increasing promoter shareholding to 18.4%.

- Tanla Platforms approves a ₹175 crore share buyback at ₹875 per share.

- RBI extends term of ICICI Bank executive director Sandeep Batra for two years.

- Macrotech Developers changes name to Lodha Developers following a trademark dispute.

- Jio BlackRock Mutual Fund introduces BlackRock's investment analytics platform Aladdin.

- Several companies bid for coal mines in the 12th round of commercial coal mine auction.

- Biocon opens Qualified Institutional Placement issue to raise ₹4,500 crore.

- Promoter entity of Vishal Mega Mart likely to sell a 10% equity stake through block deals.

- Reliance Industries sells 85 lakh shares of Asian Paints for ₹1,876 crore.

- Bata Group appoints Panos Mytaros as new Global CEO, succeeding Sandeep Kataria.

- SIL Investments board approves granting a ₹15 crore unsecured loan to Morton Foods Ltd.

- Marine Electricals receives a ₹5.71 crore order from Indian Navy for an Integrated Bridge System.

- Industry news reported on June 17, 2025.

HinduBusinessLine | 17 Jun, 2025

RIL sells 85 lakh shares of Asian Paints to ICICI Pru MF

- RIL has sold 85 lakh shares of Asian Paints to ICICI Prudential Mutual Fund.

- This follows a previous sale of 3.5 crore shares last week, leaving RIL with 87 lakh shares.

- With the latest sale, RIL will retain only around 2 lakh shares of Asian Paints.

- Last week, SBI Mutual Fund had acquired a stake in Asian Paints from RIL.

- RIL had initially acquired a stake in Asian Paints in January 2008 during the global financial crisis.

- Shares of RIL closed 0.6% higher at ₹1,436.90, while Asian Paints closed 1.2% higher at ₹2,241 on the NSE.

- The entire lot of shares was bought by ICICI Prudential Mutual Fund.

- The stake sale demonstrates RIL's divestment strategy.

- The transaction marks a reduction in RIL's ownership in Asian Paints.

- The sale highlights RIL's focus on rebalancing its portfolio.

- RIL's acquisition of a stake in Asian Paints was a strategic move during the financial crisis.

- The sale indicates RIL's shift in investment priorities over time.

- Both RIL and Asian Paints saw an increase in their stock prices post the transaction.

- The sale aligns with RIL's ongoing restructuring efforts.

- The divestment could provide RIL with capital for other investments.

- The sale comes amidst dynamic changes in the stock market and investment landscape.

HinduBusinessLine | 16 Jun, 2025

RIL Offloads More Asian Paints Shares In Rs 1,876-Crore Block Deal; ICICI Mutual Fund Steps In As Buyer

- Reliance Industries Ltd. (RIL) has sold shares worth Rs 1,876 crore in Asian Paints in a block deal, with ICICI Prudential Mutual Fund as the buyer.

- ICICI Prudential Mutual Fund acquired 85 lakh shares at Rs 2,207 apiece from Siddhant Commercials Pvt., continuing RIL's stake reduction in Asian Paints.

- Last week, RIL had sold 3.5 crore equity shares of Asian Paints through Siddhant Commercials at an average price of Rs 2,201 per share, totaling Rs 7,703 crore.

- After the recent transactions, Siddhant Commercials retained 87 lakh shares of Asian Paints.

- Asian Paints' shares closed 1.21% higher at Rs 2,241 apiece post the deal, outperforming the NSE Nifty 50's 0.98% increase.

Bloomberg Quint | 16 Jun, 2025

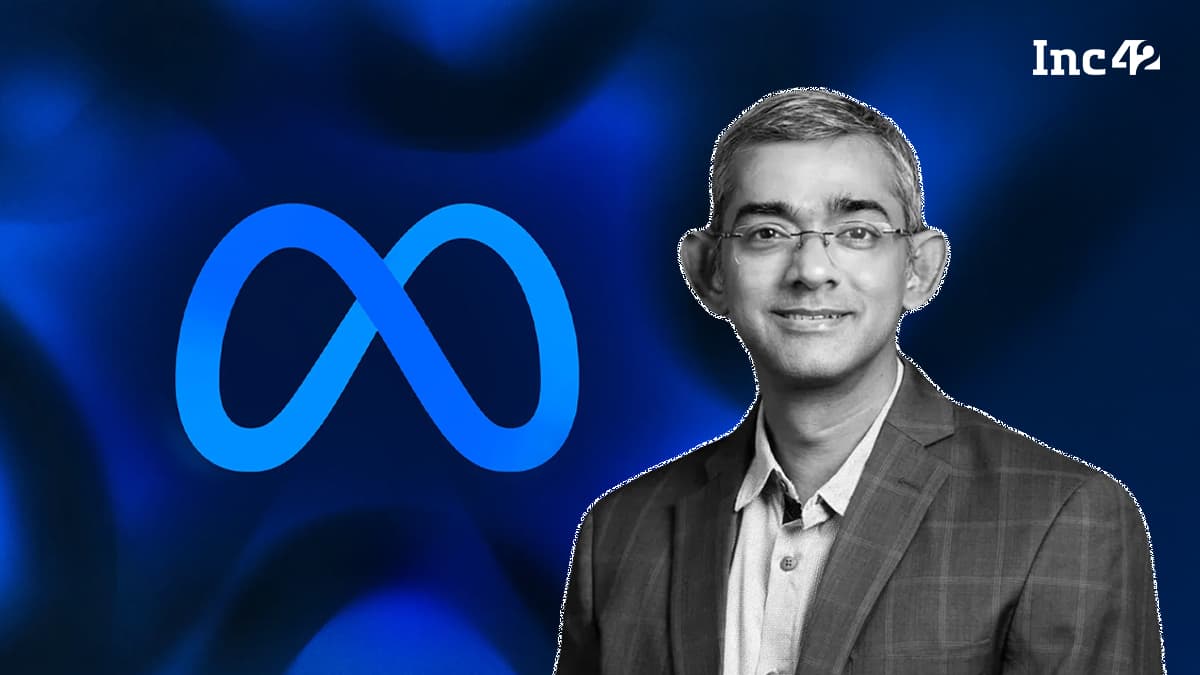

Meta Appoints Arun Srinivas As India Head

- Meta has appointed Arun Srinivas as the managing director and head for the company in India following the resignation of Shivnath Thukral, the previous head of public policy.

- Srinivas will focus on Meta's business, innovation, and revenue growth, as per the company's statement.

- He will lead the India charter, strengthen relationships with brands, advertisers, developers, and partners in the country for market growth.

- Srinivas joined Meta nearly five years ago and will transition to his new role in July, reporting to Sandhya Devanathan.

- Devanathan's role has expanded to include leadership of Meta's Southeast Asia operations.

- Srinivas has over 25 years of experience in consumer goods, tech, and other domains and was previously the director and head of Ads Business at Meta India.

- Previously, he held roles at Ola Mobility, Unilever, and Reebok.

- Meta and AI giant OpenAI are reportedly looking to partner with Indian conglomerate Reliance on new AI businesses.

- Meta is also expanding its presence in India by setting up a new office in Bengaluru and actively hiring for engineering and product roles in artificial intelligence.

- Meta's Asia-Pacific chief Dan Neary announced plans to leave after a 12-year tenure, with Benjamin Joe succeeding him.

Inc42 | 16 Jun, 2025

Asian Paints Share Price Gains After Major Block Deal

- Asian Paints share price increased by over 1% following a block deal where 85 lakh shares were exchanged.

- Reliance Industries sold 3.5 crore equity shares of Asian Paints in a previous block deal at an average price of Rs 2,201 per share.

- The total transaction value of the block deal amounted to Rs 7,703 crore.

- SBI Mutual Fund bought the entire 3.64% equity stake in the block deal.

- Asian Paints' share price rose 1.07% to Rs 2,237.90 apiece after the block deal.

- The stock was trading 0.28% higher at Rs 2,220.50 apiece.

- Asian Paints shares have fallen 23.92% in the last 12 months.

- Out of 39 analysts tracking the company, seven recommend 'buy', 10 suggest 'hold', and 22 advise 'sell'.

- The average 12-month consensus price target implies a 3.5% upside.

- Asian Paints' relative strength index was at 36.

- The NSE Nifty 50 advanced by 0.053%.

- The company had a total traded volume 1.6 times its 30-day average.

- Reliance Industries mentioned retaining a balance of 87 lakh shares of Asian Paints.

- The stock market saw a gain of over 700 points with HDFC Bank leading.

- Asian Paints stock news and live updates are available on NDTV Profit.

- The stock market saw a gain of over 700 points with HDFC Bank leading.

Bloomberg Quint | 16 Jun, 2025

Stock Market Highlights: Investors Lose Rs 2.96 Lakh Crore As Sensex, Nifty Slump On Israel-Iran Tensions

- The Indian stock market witnessed a decline as the benchmark indices, NSE Nifty 50 and BSE Sensex, closed lower due to prevailing tensions between Israel and Iran.

- NSE Nifty 50 ended 169 points (0.68%) lower at 24,718.60, while BSE Sensex closed 573 points (0.70%) down at 81,118.

- During the day, Nifty fell by 1.67% to trade at 24,473, and Sensex declined by 1.64% to 80,354.59.

- This week, both Nifty and Sensex fell by more than 1%, with Nifty decreasing by 500 points from its weekly high, breaking a two-day gaining streak.

- Top losers in Nifty included Eternal Ltd. and Adani Ports, while Nifty Midcap 150 and Nifty Smallcap 250 also recorded declines.

- Nifty Realty sector performed poorly with Brigade Enterprises Ltd. and Raymond Ltd. among the top losers.

- Shares of Bharat Electronics Ltd. and Oil and Natural Gas Corp. were the top gainers, while Adani Ports and Special Economic Zones Ltd. and ITC Ltd. faced losses.

- Bharat Electronics Ltd. and Tata Consultancy Services Industries Ltd. contributed to gains in the index, while HDFC Bank Ltd. and Reliance Industries Ltd. were major drags.

- On NSE, nine out of 11 sectors ended in the red, with Nifty PSU Bank, FMCG, and Bank sectors among the top losers.

- Overall, both BSE MidCap and BSE SmallCap closed 0.26% lower, indicating a negative trend in the broader market indices.

- Market breadth favored sellers with 1,530 stocks advancing, 2,547 declining, and 136 remaining unchanged on the BSE.

- The ongoing tensions between Israel and Iran impacted the market performance adversely.

- The situation led to a downtrend in various sectors and indices, resulting in investor concerns.

- The market outlook remains uncertain due to geopolitical tensions and other external factors.

- Investors are monitoring the developments closely to assess the market direction and plan their investment strategies accordingly.

Bloomberg Quint | 13 Jun, 2025

Asian Paints Share Price Slides After Reliance Sells Stake

- Reliance Industries sold equity worth Rs 7,703 crore in Asian Paints through its affiliate Siddhant Commercials Ltd.

- The sale involved 3.5 crore equity shares at Rs 2,201 per share.

- SBI Mutual Fund was the sole buyer of these shares.

- Shares of Asian Paints fell over 2% following the stake sale by Reliance Industries.

- Asian Paints' stock price dropped by 2.01% to Rs 2,174 apiece.

- Afterward, it traded 1.06% lower at Rs 2,195 apiece.

- The stock has declined by 24.54% in the last 12 months.

- Analysts' consensus price target implies an upside of 23.7% for Asian Paints.

- SBI Mutual Fund, previously holding a 1.51% stake in Asian Paints, has now increased its shareholding.

- Reliance Industries retains 87 lakh equity shares in Asian Paints post the stake sale.

- The sale represented 3.64% of Asian Paints' total equity.

- Siddhant Commercials previously held a 4.9% stake in the paint manufacturer.

- 39 analysts tracking the company have varied opinions on Asian Paints' stock.

- The stock's relative strength index was at 31.

- The article discusses how the stock performed compared to broader market indices like the NSE Nifty 50.

Bloomberg Quint | 13 Jun, 2025

Reliance Industries Share Price Falls As Israel-Iran Conflict Triggers Crude Oil Rally

- Reliance Industries' share price fell as oil prices surged due to Israel's military strikes on Iran, causing concerns of a wider conflict in a key crude oil region.

- Brent crude rose over 13% and West Texas Intermediate also surged, experiencing the largest one-day gains since May 2022.

- Israeli Prime Minister Benjamin Netanyahu mentioned the strikes targeted Iran's nuclear program and military capabilities, with ongoing operations until the perceived threat is eliminated.

- The escalation in tensions led to fears of oil supply disruptions, impacting global supply chains and increasing uncertainties in the region.

- The conflict also raises doubts about the upcoming nuclear talks between the US and Iran, as President Donald Trump expressed skepticism about reaching a deal amid the heightened tensions.

- Despite initial losses, Reliance's share price only decreased by 1.18% following the oil price surge, outperforming the 1.15% drop in the NSE Nifty 50 Index.

- Reliance's stock has seen a YTD rise of 18.61% but a 1.61% dip in the last 12 months, with analysts mostly maintaining a 'buy' rating with an average upside potential of 8%.

Bloomberg Quint | 13 Jun, 2025

RIL Eyes Slice Of OpenAI Pie, Why Mainstreet Hung Up Its Shoes & More

- OpenAI is in talks with Reliance Industries, Saudi Arabia’s Public Investment Fund, and UAE-based MGX for the second tranche of its $40 billion fundraise, potentially valuing OpenAI at $300 billion post-money.

- Reliance's stake in OpenAI could integrate advanced AI offerings into its network, and OpenAI could develop AI solutions tailored for Indian languages.

- Mainstreet, despite raising $2 million, faced financial challenges due to excessive spending on salaries and marketing.

- GIVA, a D2C jewellery startup, has garnered INR 500 crore in revenue by focusing on Gen Z and millennials.

- SEBI's proposed CIV model aims to streamline co-investments under AIFs.

- Meesho plans to file its IPO papers and relocate from the US to India soon.

- Spinny raised $30 million from WestBridge in its latest funding round, closing the Series F at $170 million.

- PhonePe and Google Pay dominated the UPI market in May, with PhonePe leading in transaction volume.

- ArisInfra files for an IPO to raise about INR 500 crore, set to open for subscription on June 17.

- Krutrim unveils Agentic AI, an AI multimodal assistant available in 11 languages.

- Fitsol, an AI-powered carbon management platform, helps organisations measure, report, and reduce emissions across Scope 1, 2, and 3.

- Fitsol received $1 million in seed funding to support industries in their net-zero journey.

- Fitsol aims to simplify carbon management for businesses amidst increasing focus on corporate sustainability.

Inc42 | 13 Jun, 2025

Powered by

Reliance Industries Subsidiaries

Jio

4.0

• 25.5k reviews

Reliance Retail

3.9

• 24k reviews

Jio Platforms

3.4

• 1.7k reviews

Embibe

3.5

• 681 reviews

RadiSys

4.0

• 490 reviews

Reliance Life Sciences

3.6

• 465 reviews

Report error

Compare Reliance Industries with

Hindustan Petroleum

4.2

Oil And Natural Gas Corporation

4.3

GAIL

4.4

Petrofac

4.3

Schlumberger

3.9

Linde India

4.0

Reliance BP Mobility

3.5

Saudi Aramco

4.5

Baker Hughes

4.0

ExxonMobil

3.8

bp

3.8

TotalEnergies

3.8

NTPC GE Power Services

3.8

Columbia Petro Chem

3.9

Vcs Quality Services

4.1

Ksk Energy Ventures

4.5

SONATRACH

3.7

OCS Services

4.4

Wellcare Oil Tools

4.1

Great Eastern Shipping Company

4.2

Contribute & help others!

You can choose to be anonymous

Companies Similar to Reliance Industries

Indian Oil Corporation

Oil / Gas / Petro Chemicals, Power, Hardware & Networking, Oil & Gas, Software Product

4.4

• 3.2k reviews

Shell

Oil / Gas / Petro Chemicals, Power, Oil & Gas

4.0

• 2.4k reviews

Bharat Petroleum

Power, Oil & Gas, Petrochemicals

4.1

• 1.8k reviews

Hindustan Petroleum

Oil / Gas / Petro Chemicals, Oil & Gas

4.2

• 1.5k reviews

Oil And Natural Gas Corporation

Oil / Gas / Petro Chemicals, Oil & Gas

4.3

• 1.1k reviews

GAIL

Oil & Gas

4.4

• 972 reviews

Petrofac

Oil / Gas / Petro Chemicals, Oil & Gas

4.3

• 912 reviews

Schlumberger

Chemicals / Agri Inputs, Industrial Machinery, Manufacturing, Oil / Gas / Petro Chemicals, Oil & Gas

3.9

• 797 reviews

Linde India

Engineering & Construction, Oil & Gas

4.0

• 697 reviews

Reliance BP Mobility

Oil / Gas / Petro Chemicals, Oil & Gas

3.5

• 613 reviews

Saudi Aramco

Oil / Gas / Petro Chemicals, Oil & Gas

4.5

• 540 reviews

Baker Hughes

Oil & Gas

4.0

• 511 reviews

Reliance Industries FAQs

When was Reliance Industries founded?

Reliance Industries was founded in 1977. The company has been operating for 48 years primarily in the Oil & Gas sector.

Where is the Reliance Industries headquarters located?

Reliance Industries is headquartered in Navi Mumbai, Maharashtra and has an office in Mumbai.

How many employees does Reliance Industries have in India?

Reliance Industries currently has more than 3.5 Lakh+ employees in India. Production, Manufacturing & Engineering department appears to have the highest employee count in Reliance Industries based on the number of reviews submitted on AmbitionBox.

Does Reliance Industries have good work-life balance?

Reliance Industries has a Work-Life Balance Rating of 3.9 out of 5 based on 17,000+ employee reviews on AmbitionBox. 75% employees rated Reliance Industries 4 or above, while 25% employees rated it 3 or below on work-life balance. This indicates that the majority of employees feel a generally balanced work-life experience, with some opportunities for improvement based on the feedback. We encourage you to read Reliance Industries work-life balance reviews for more details.

Is Reliance Industries good for career growth?

Career growth at Reliance Industries is rated as moderate, with a promotions and appraisal rating of 3.3. 25% employees rated Reliance Industries 3 or below, while 75% employees rated it 4 or above on promotions / appraisal. This rating suggests that while some employees view growth opportunities favorably, there is scope for improvement based on employee feedback. We recommend reading Reliance Industries promotions / appraisals reviews for more detailed insights.

What are the pros and cons of working in Reliance Industries ?

Working at Reliance Industries comes with several advantages and disadvantages. It is highly rated for job security, skill development and work life balance. However, it is poorly rated for promotions / appraisal and salary & benefits, based on 17,000+ employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Trusted by over 1.5 Crore job seekers to find their right fit company

80 Lakh+

Reviews

10L+

Interviews

4 Crore+

Salaries

1.5 Cr+

Users

Contribute to help millions

AmbitionBox Awards

Get AmbitionBox app