Security and Intelligence Services (India)![]()

Working at Security and Intelligence Services (India)

Company Summary

Overall Rating

8% above

Highly rated for

Job security, Work-life balance, Company culture

Work Policy

Top Employees Benefits

About Security and Intelligence Services (India)

SIS Group Enterprises commenced operations as a two-member company in 1974 and has since transformed into one of the market leaders in the Asia Pacific region, in Security, Facility Management and Cash Logistics segments, all of which are essential to the functioning of a healthy economy.

This would only be possible by leveraging the power of technology. The group has adopted a tech-led approach, which has steadily brought greater efficiency to the operation and offered a unique customer experience through its digital platform, like iOPS, ARK, SalesMaxx, NQC, RQC, iPorter, SSDP, TFM, iQMS, iFMOps and MySIS app.

SIS Group Enterprises has the largest command center in India to manage 5,00,000 sites while establishing a leadership position in the e-surveillance industry. Over the years, the enterprise has steadily and strategically expanded its operations. Currently, SIS Group Enterprises is present across 28 Indian states and 8 Union Territories and has penetrated international markets like Australia, New Zealand and Singapore.

The relentless focus on innovation to provide evolved solutions to its customers has resulted in emerging as one of the fastest-growing Security, Facility Management and Cash Logistics Solutions providers in India and the Asia-Pacific region.

Security and Intelligence Services (India) Ratings

Overall Rating

Category Ratings

Job security

Work-life balance

Company culture

Salary

Skill development

Work satisfaction

Promotions

Work Policy at Security and Intelligence Services (India)

Security and Intelligence Services (India) Reviews

Top mentions in Security and Intelligence Services (India) Reviews

Compare Security and Intelligence Services (India) with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 4.1/5 based on 1.5k reviews | 3.9/5 based on 2.4k reviews | 4.4/5 based on 733 reviews | 4.4/5 based on 676 reviews |

Highly Rated for | Work-life balance Job security Skill development | Work-life balance Salary Job security | Job security Salary Company culture | Job security Salary Skill development |

Critically Rated for |  No critically rated category | Promotions |  No critically rated category | Promotions |

Primary Work Policy | Work from office 71% employees reported | Work from office 74% employees reported | Work from office 72% employees reported | Work from office 86% employees reported |

Rating by Women Employees | 3.9 Good rated by 62 women | 3.4 Average rated by 165 women | 3.7 Good rated by 5 women | 3.8 Good rated by 24 women |

Rating by Men Employees | 4.2 Good rated by 1.3k men | 4.0 Good rated by 1.9k men | 4.4 Good rated by 640 men | 4.4 Good rated by 593 men |

Job security | 4.0 Good | 3.8 Good | 4.6 Excellent | 4.5 Good |

Security and Intelligence Services (India) Salaries

Security Officer

Security Supervisor

Accountant

Supervisor

Compliance Executive

Assistant Security Officer

Branch Head

Sales Manager

Operations Executive

Operations Manager

Security and Intelligence Services (India) Interview Questions

Security and Intelligence Services (India) Jobs

Security and Intelligence Services (India) News

Tanla Platforms To Mull Buyback of Equity Shares At Board Meeting On June 16

- Tanla Platforms Ltd.'s board of directors will discuss a buyback of equity shares at an upcoming meeting.

- The trading window for insiders involved in the buyback will be closed from June 11 to June 18.

- SIS Ltd. has also approved a buyback of shares not exceeding Rs 150 crore at Rs 404 apiece.

- The buyback for SIS Ltd. will be open from June 12 to June 18.

- Before the announcement, Tanla Platforms' shares closed 1.03% lower at Rs 622.65 apiece.

- The stock has seen a 32.51% decline in the last 12 months and a 7.36% decrease this year.

- Two analysts tracking the company have a 'buy' rating on the stock.

- The average of 12-month analysts' price targets suggests a potential downside of 2.5%.

Stock Market Today: All You Need To Know Going Into Trade On June 11

- Indian benchmark equity indices closed flat on Tuesday, with Sensex ending lower while Nifty 50 ended slightly higher.

- Foreign portfolio investors remained net buyers of Indian equities, while domestic institutional investors continued to be net buyers.

- Stocks to watch include Wipro extending partnership with Metro AG, Aditya Birla Capital's sale offer, SIS's equity share buyback, and Vodafone Idea launching 5G services in Bengaluru.

- Other companies making news are Sonata Software, CreditAccess Grameen, Reliance Infrastructure, Popular Vehicles and Services, among others.

- Block deals included Premier Energies and bulk deals featured Scoda Tubes, Shankara Building Products, and AU Small Finance Bank.

- Insider trades reported include transactions in NCL Industries, Diamond Power Infrastructure, Avantel, B. L. Kashyap and Sons, and others.

- Trading tweaks saw price band changes for Oriental Carbon & Chemicals and TVS Electronics, while Nifty futures showed a downtrend.

- In the currency and bond market, the rupee closed flat against the dollar, and the 10-year government bond yield ended at 6.36%.

- F&O cues indicated Nifty futures down, with certain securities in the ban period.

- Overall, the market showed a mix of company updates, trading activities, and market indicators to watch for in the upcoming sessions.

Buy, Sell Or Hold: Coforge, TCI Express, TTK Prestige, SIS, ONGC, PNB — Ask Profit

- Analysts provided insights on the stock prices of Coforge, TCI Express, TTK Prestige, SIS, ONGC, PNB, and Motherson Sumi Wiring India.

- For Coforge, analysts recommend holding due to its strong fundamentals despite short-term challenges in the IT sector.

- TCI Express is advised for a wait-and-watch approach as its PE ratio and margins appear expensive.

- TTK Prestige may experience a flat or negative fourth-quarter, making it advisable to wait for a significant dip before investing.

- SIS is suggested to be held, but no additional shares are recommended for purchase.

- ONGC investors are advised to diversify their portfolio for better dividend yields within the sector.

- PNB is a hold according to analysts, with potential for growth driven by credit expansion in the PSU banking sector.

- Motherson Sumi is suggested for holding with a stop loss set at Rs 45 for a three to six-month period.

- Investors are cautioned to consult their financial advisers before making any investment decisions based on the analysts' views.

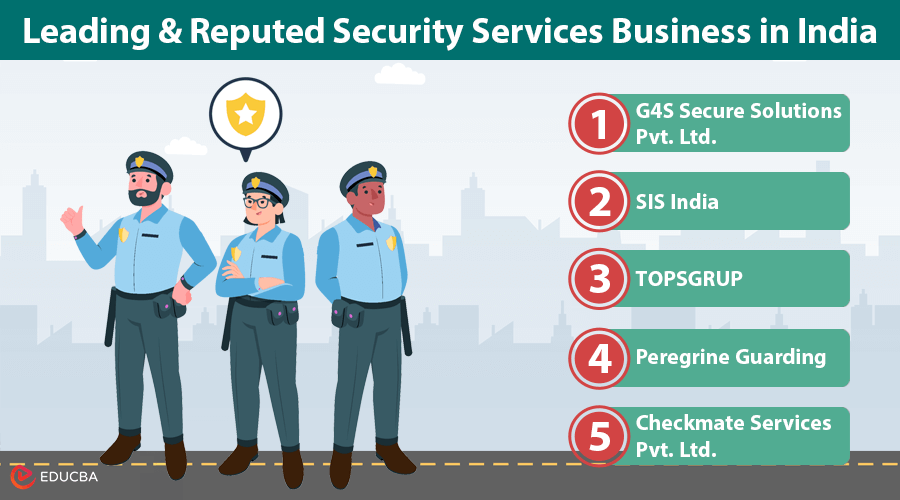

Security Services Business in India

- The security services business in India has experienced significant growth due to rising safety concerns and demand for surveillance, creating a lucrative opportunity for entrepreneurs.

- The industry is heavily regulated, with the Private Security Agencies (Regulation) Act, 2005 (PSARA Act) being a key law governing security agencies in India.

- To start a security services business, obtaining a PSARA license is essential, requiring a structured legal and operational framework.

- Business entities need to choose the right entity type (e.g., sole proprietorship, LLP, or private limited company) based on scalability and compliance needs.

- The PSARA application process involves MoU with a recognized training institute, documentation such as PAN, TAN, proof of office, and personal credentials of promoters.

- After obtaining the PSARA license, businesses must fulfill statutory registrations, including EPF, ESI, Shops and Establishments, Labour Welfare Fund, and professional tax, among others.

- Hiring and deploying security personnel require adherence to eligibility criteria, training, and maintaining operational records for regulatory inspections.

- Mitigating risks through insurance coverage and clear client contracts, alongside managing financial aspects like billing models and tax compliance, are crucial for a security agency.

- To build a successful security business, marketing efforts, brand building, and partnerships with real estate developers and corporate offices are essential.

- Leading security services agencies in India include G4S, SIS India, TOPSGRUP, Peregrine Guarding, Checkmate Services, Securitas India, CMS Security Services, Walsons Services, and Bhartiya Suraksha Sansthan.

- Establishing a security services business in India offers growth opportunities but requires strict compliance with legal obligations and operational readiness to succeed in the evolving security landscape.

Security and Intelligence Services (India) Perks & Benefits

Security and Intelligence Services (India) Offices

Compare Security and Intelligence Services (India) with

Contribute & help others!

Companies Similar to Security and Intelligence Services (India)

Security and Intelligence Services (India) FAQs

Reviews

Interviews

Salaries

Users