Add office photos

Employer?

Claim Account for FREE

First Solar![]()

3.8

based on 111 Reviews

Video summary

Company Overview

Company Locations

Working at First Solar

Company Summary

A leader in photovoltaic module manufacturing, the company focuses on solar energy solutions using advanced thin-film technology to maximize efficiency and production.

Overall Rating

3.8/5

based on 111 reviews

3% above

industry average

Highly rated for

Job security

Critically rated for

Promotions, Work satisfaction

Work Policy

Work from office

90% employees reported

Rotational Shift

51% employees reported

Flexible timing

66% employees reported

No travel

38% employees reported

View detailed work policy

Top Employees Benefits

Cafeteria

3 employees reported

Job/Soft skill training

3 employees reported

Office cab/shuttle

2 employees reported

Free meal

2 employees reported

View all benefits

About First Solar

Founded in2006 (19 yrs old)

India Employee Count--

Global Employee Count5k-10k

HeadquartersTempe,Arizona, United States

Office Locations

--

Websitefirstsolar.com

Primary Industry

Other Industries

Are you managing First Solar's employer brand? To edit company information,

claim this page for free

View in video summary

Like the ancient Egyptians who worshiped Ra, First Solar looks to the sun for rising fortunes. The company manufactures photovoltaic (PV) modules for converting sunlight into electricity. Using a thin-film semiconductor process, a piece of glass is transformed into a complete solar module in less than three hours. The technology is cheaper and produces more electricity under real-world conditions than conventional solar panels with similar power ratings. Founded in Ohio, more than 90% of its sales come from outside the US, primarily from solar project developers and system integrators in France, Germany, Italy, and Spain. First Solar also provides solar power plant project development services.

Report error

Managing your company's employer brand?

Claim this Company Page for FREE

First Solar Ratings

based on 111 reviews

Overall Rating

3.8/5

How AmbitionBox ratings work?

5

41

4

36

3

14

2

9

1

11

Category Ratings

3.8

Job security

3.7

Work-life balance

3.6

Company culture

3.6

Skill development

3.4

Salary

3.3

Work satisfaction

2.9

Promotions

First Solar is rated 3.8 out of 5 stars on AmbitionBox, based on 111 company reviews.This rating reflects an average employee experience, indicating moderate satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at First Solar

based on 108 reviews

4.0

Rated by 24 Women

Rated 4.1 for Job security and 4.0 for Skill development

3.8

Rated by 84 Men

Rated 3.8 for Job security and 3.7 for Work-life balance

Work Policy at First Solar

based on 47 reviews in last 6 months

Work from office

90%

Hybrid

8%

Permanent work from home

2%

First Solar Reviews

Top mentions in First Solar Reviews

Compare First Solar with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 3.8/5 based on 111 reviews | 3.9/5 based on 4.9k reviews | 3.7/5 based on 4.6k reviews | 3.9/5 based on 5.2k reviews |

Highly Rated for | Job security | Job security Skill development |  No highly rated category | Salary Skill development |

Critically Rated for | Promotions Work satisfaction | Promotions | Job security Promotions | Job security |

Primary Work Policy | Work from office 90% employees reported | Work from office 79% employees reported | Work from office 47% employees reported | Work from office 50% employees reported |

Rating by Women Employees | 4.0 Good rated by 24 women | 3.7 Good rated by 476 women | 3.4 Average rated by 550 women | 3.5 Good rated by 261 women |

Rating by Men Employees | 3.8 Good rated by 84 men | 3.9 Good rated by 4.2k men | 3.8 Good rated by 3.8k men | 4.0 Good rated by 4.5k men |

Job security | 3.8 Good | 3.9 Good | 3.2 Average | 3.0 Average |

View more

First Solar Salaries

First Solar salaries have received with an average score of 3.4 out of 5 by 111 employees.

Manufacturing Engineer

(29 salaries)

Unlock

₹4 L/yr - ₹9.5 L/yr

Automation Technician

(9 salaries)

Unlock

₹2.5 L/yr - ₹6.6 L/yr

Manufacturing Engineering Technician

(9 salaries)

Unlock

₹2 L/yr - ₹4 L/yr

Technical Supervisor

(8 salaries)

Unlock

₹4.5 L/yr - ₹9 L/yr

Maintenance Engineer

(6 salaries)

Unlock

₹3 L/yr - ₹5.5 L/yr

Manufacturing Associate

(5 salaries)

Unlock

₹2.4 L/yr - ₹4.5 L/yr

Production Engineer

(5 salaries)

Unlock

₹2.2 L/yr - ₹8.7 L/yr

Maintenance Supervisor

(5 salaries)

Unlock

₹2.8 L/yr - ₹11.6 L/yr

L2 Engineer

(5 salaries)

Unlock

₹6.2 L/yr - ₹11.8 L/yr

Warehouse Supervisor

(5 salaries)

Unlock

₹4.6 L/yr - ₹9.4 L/yr

First Solar News

View all

Three Stocks Sold Off By Up to 23.97%

- The solar energy stock rebound ended with Enphase Energy (ENPH) dropping by 23.97% and First Solar (FSLR) by 17.89%.

- Republicans proposed changes to the President’s tax and spending bill, suggesting phasing out solar and wind energy tax credits by 2028.

- Array Technologies (ARRY) and SolarEdge (SEDG) also experienced sell-offs within the sector.

- Investors are expected to move away from solar and clean energy investments towards hydro, nuclear, and geothermal power stocks.

- The bill aims to extend tax credits until 2036, potentially benefiting 'dirty' oil and gas stocks like Chevron (CVX), Devon Energy (DVN), and Occidental Petroleum (OXY).

- Investors are advised to be cautious about potential downturns in electric vehicle companies like Tesla (TSLA), Rivian Automotive (RIVN), and Lucid Group (LCID).

- AES (AES) saw an 8.12% drop to close at $10.53, showing a bullish multiple bottom near $10.00 despite losing half its value in the last year.

Baystreet | 18 Jun, 2025

Solar stocks are plummeting as the Senate version of Trump's 'big beautiful bill' hits clean energy

- Solar energy stocks plunged for a second day as the Senate version of the budget bill retains cuts to renewable energy tax credits.

- The US Senate panel proposed phasing out all tax credits for solar and wind energy within the next three years, causing a sharp decline in solar stocks including First Solar, SolarEdge, and Sunrun.

- The proposed policy changes are part of President Trump's 'One Big Beautiful Bill Act' and favor tax credits for hydropower, nuclear, and geothermal energy.

- Senator Mike Crapo released a bill summary aiming to eliminate clean energy subsidies, sparking backlash from the clean energy industry.

- Advocates, including Rewiring America's CEO, argue against eliminating tax credits for solar and wind energy, calling it a profound mistake.

- Washington policy analyst Ed Mills notes that the Senate proposal is a negative for renewable energy investment, but an improvement over the House version.

- The Senate's plan could eliminate subsidies that have supported renewable power industry growth and benefit companies in other energy sectors.

- The proposed changes could have significant economic impacts on the clean energy industry if implemented.

- Solar stocks saw heavy losses following news of the Senate's budget bill decisions, with further declines expected if the proposal progresses.

- The renewable energy sector is closely monitoring developments as the Senate deliberates the future of clean energy tax credits.

Insider | 18 Jun, 2025

Why Solar Energy Stocks Plunged By 20% or More

- Solar energy stocks plunged by over 20% as the U.S. House passed a bill cutting clean energy subsidies unexpectedly.

- Companies like Emphase Energy, NextEra Energy, AES, First Solar, Array Technologies, and Sunrun are affected by the removal of subsidies.

- The subsidies were part of the Biden Administration's Inflation Reduction Act; eliminating them will impact solar rooftop solutions and electric vehicle stocks.

- Investors are advised to steer clear of the solar energy sector for now due to the policy changes and potential impact on stock prices.

Baystreet | 23 May, 2025

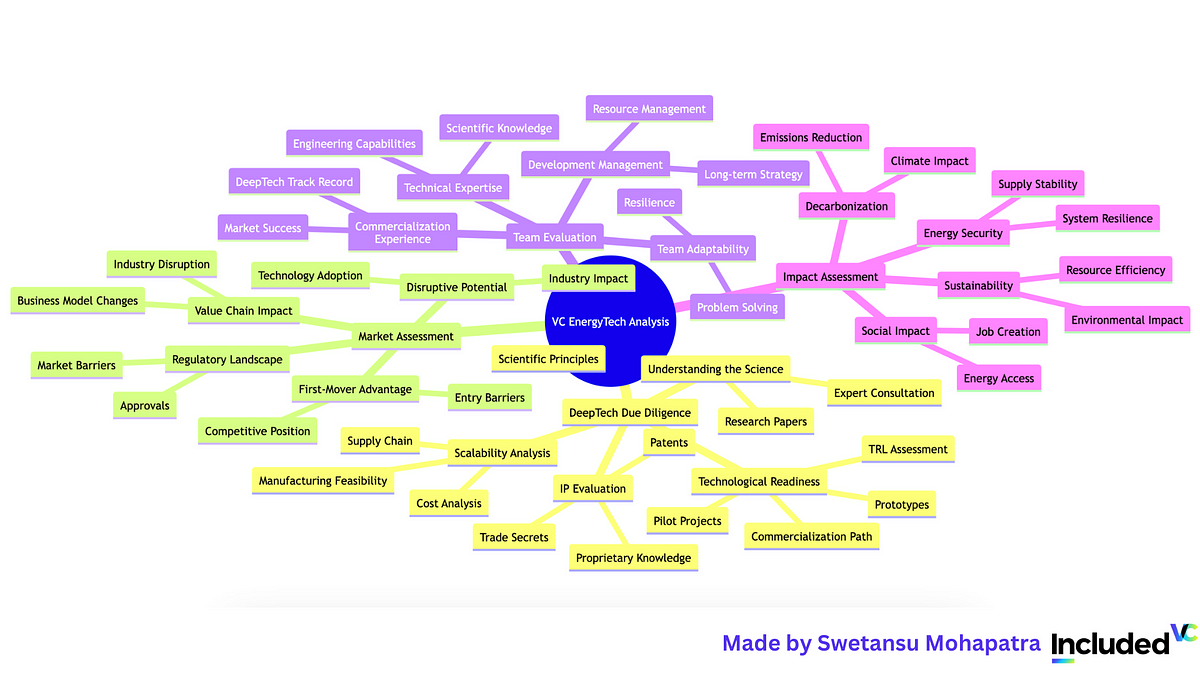

A Deep Dive into Deeptech in the Energy Sector

- Deeptech in the energy sector addresses major global challenges like climate change and resource scarcity, supported by VCs driving innovation towards a sustainable future.

- Companies like First Solar and SunPower have used Deeptech to enhance solar energy efficiency, making it a mainstream power source.

- Tesla's innovations in battery technology have revolutionized electric vehicles and energy storage with products like Powerwall and Megapack.

- The energy sector is on the brink of innovative advancements driven by Deeptech, with trends in various sub-sectors reshaping the industry.

- Deeptech energy startups arise from research hubs, universities, and emerging entrepreneurial ecosystems, founded by experts in the field.

- Funding Deeptech energy startups requires a unique approach due to longer development cycles and higher capital needs, but with potentially significant rewards.

- Deeptech valuations depend on long-term potential, team expertise, market size, and technological advancement, often surpassing traditional software startups in value.

- Corporations are actively engaging with Deeptech energy startups, investing in and partnering for access to innovative technologies, enhancing sustainability and efficiency.

- Deeptech startups in the energy sector contribute to the food-water-energy nexus, fostering sustainable and resilient systems with innovative solutions.

- Semiconductor manufacturing and data centers are examples of energy-intensive processes that Deeptech is transforming to enhance energy efficiency and sustainability.

- VCs analyzing EnergyTech Derivatives focus on technological underpinnings, market assessment, team expertise, and impact on the energy transition to identify promising investments.

Medium | 20 May, 2025

TSX Dangles Lower over Trade Worry

- On Wednesday, equities in Canada fell as concerns over the impact of U.S. President Trump's tariff policies intensified.

- The TSX Composite Index managed to climb by the end of the day, closing at 24,841.68.

- Canadian dollar edged up at 72.54 cents U.S. with technology stocks facing significant losses.

- Energy companies like International Petroleum and Vermilion Energy saw declines.

- Health-care stocks, including Bausch Health Companies, also experienced decreases.

- On the positive side, telecoms like Cogeco and Quebecor showed gains, along with consumer staples and utilities.

- The TSX Venture Exchange declined, with energy and health-care sectors bearing the brunt.

- In contrast, telecoms, consumer staples, and utilities posted gains.

- On Wall Street, the S&P 500 and Dow Jones saw modest gains amidst economic contraction concerns and volatile trading.

- The NASDAQ remained in the red, while companies like First Solar and GE HealthCare cut forecasts due to tariffs.

Baystreet | 1 May, 2025

Dow Pops After Earlier Selloff, S&P Gains

- S&P 500 posted narrow gains amid volatile trading as U.S. economy contracted in Q1 and recession fears grew.

- Dow Jones jumped 141.74 points to 40,669.36, S&P 500 gained 8.23 points to 5,569.06, while NASDAQ fell by 14.98 points.

- First Solar shares dropped over 8% due to tariffs impact, GE HealthCare cut forecast, and Nvidia shares dipped alongside Super Micro Computer's decline.

- Q1 GDP shrank by 0.3%, showing a big slowdown in consumer spending and government spending, indicating economic challenges ahead.

Baystreet | 1 May, 2025

Stocks Still Trudge on Ailing GDP Numbers

- Equities in Canada fell as a contraction in the domestic and U.S. economies intensified worries about the impact of Trump's tariff policies.

- The TSX Composite Index dropped 181.61 points to 24,692.87, and the Canadian dollar inched up to 72.38 cents U.S.

- On Wall Street, stocks fell as data showed the U.S. economy contracted in the first quarter, with the Dow Jones Industrials down 232.18 points to 40,295.44.

- Concerns arose that Trump's policy moves, especially on trade, could lead to a recession, as shown by a decline in GDP, slow private payroll growth, and negative impacts on companies like First Solar and GE Healthcare.

Baystreet | 30 Apr, 2025

GDP Numbers Help Set off Selloff

- Stocks fell on Wednesday as data showed the U.S. economy contracted in the first quarter, sparking fears of a recession under the weight of President Trump’s policy moves, especially on trade.

- Major stock indexes like the Dow Jones, S&P 500, and NASDAQ were down, with companies like First Solar and GE Healthcare cutting forecasts due to Trump's tariffs.

- AI chip company Nvidia saw a decline in shares, following server maker Super Micro Computer's weak results. First quarter GDP fell at a 0.3% rate due to a surge in imports amid trade uncertainties.

- The weak GDP report and slowing private payroll growth in April raised concerns of an economic slowdown. Former President Trump attributed the weak numbers to a 'Biden Overhang' and urged patience for his policies to take effect.

Baystreet | 30 Apr, 2025

Selloff Intensifies After Lower GDP Numbers

- Stocks fell on Wednesday due to lower GDP numbers and concerns about the U.S. economy slipping into a recession under Trump's policies.

- Dow Jones tumbled 1.4%, S&P 500 slid 1.6%, and NASDAQ weakened by 2.1%.

- First Solar shares plunged over 9% due to impact from trade tariffs, while Nvidia fell over 2% in sympathy with Super Micro Computer's decline.

- First quarter GDP declined by 0.3%, led by a surge in imports and a slowdown in consumer spending. ADP's report also indicated a slowdown in private payroll growth.

Baystreet | 30 Apr, 2025

U.S. reshapes the non-China solar supply chain

- The U.S. Department of Commerce revised antidumping and countervailing duties on solar products from Vietnam and Malaysia in December 2024, affecting the non-China solar supply chain.

- Imposition of AD/CVDs by the U.S. on solar modules from Vietnam, Malaysia, Thailand, and Cambodia resulted in a decline in imports from these nations.

- First Solar is expected to represent 20% of the U.S. home market, and U.S. cell production is set to drive up domestic solar manufacturing in 2025.

- U.S. solar demand may slow due to trade policy uncertainty and the slow growth of domestic manufacturers.

- The U.S. energy storage market, led by utility-side installations, saw significant growth in California, Texas, and other states in 2024.

- There is uncertainty in the U.S. energy storage market due to potential policy changes, but growth is expected to continue driven by large projects and evolving technology.

- While the U.S. market faces uncertainties, Europe, the Middle East, India, Southeast Asia, and Africa are expected to drive the global PV and energy storage markets in 2025.

- Global support from emerging markets will offset any short-term impact of a slowdown in U.S. demand, ensuring long-term growth in PV and energy storage sectors.

- Companies are advised to monitor policy changes, adapt market strategies, and capitalize on growth opportunities in emerging markets for a competitive edge in the energy transition.

Pv-Magazine | 4 Apr, 2025

Powered by

Compare First Solar with

Oyo Rooms

3.2

Lenskart

3.2

Ola Cabs

3.3

CarDekho Group

3.7

Rebel Foods

3.7

OLX

3.8

ByteDance

4.0

Airbnb

3.7

LinkedIn

4.3

Avis

3.8

Facebook

4.3

Yahoo

4.6

BCForward

3.5

Vistaprint

3.4

Hermes I Tickets

4.5

eBay

4.0

Ball Corporation

2.9

Cigna

3.1

ACCIONA

3.7

Gardner Denver Engineered Products

4.0

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Companies Similar to First Solar

First Solar FAQs

When was First Solar founded?

First Solar was founded in 2006. The company has been operating for 19 years primarily in the Internet sector.

Where is the First Solar headquarters located?

First Solar is headquartered in Tempe,Arizona.

Does First Solar have good work-life balance?

First Solar has a Work-Life Balance Rating of 3.7 out of 5 based on 100+ employee reviews on AmbitionBox. 69% employees rated First Solar 4 or above, while 31% employees rated it 3 or below on work-life balance. This indicates that the majority of employees feel a generally balanced work-life experience, with some opportunities for improvement based on the feedback. We encourage you to read First Solar work-life balance reviews for more details.

Is First Solar good for career growth?

Career growth at First Solar is rated as poor, with a promotions and appraisal rating of 2.9. 31% employees rated First Solar 3 or below on promotions / appraisal. This rating reflects a negative sentiment among employees for career growth. We recommend reading First Solar promotions / appraisals reviews for more detailed insights.

What are the pros and cons of working in First Solar?

Working at First Solar comes with several advantages and disadvantages. It is highly rated for job security. However, it is poorly rated for promotions / appraisal, work satisfaction and salary & benefits, based on 100+ employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Trusted by over 1.5 Crore job seekers to find their right fit company

80 Lakh+

Reviews

10L+

Interviews

4 Crore+

Salaries

1.5 Cr+

Users

Contribute to help millions

AmbitionBox Awards

Get AmbitionBox app