Add office photos

Employer?

Claim Account for FREE

Havells![]()

3.9

based on 4k Reviews

Video summary

Company Overview

Associated Companies

Company Locations

Working at Havells

Company Summary

Rediscover the joy of fresh living & eating with Havells Domestic Appliances Fans, Home & Kitchen Appliances, Led Lights, Personal Grooming etc.

Overall Rating

3.9/5

based on 4k reviews

On-Par with

industry average

Highly rated for

Salary, Work-life balance

Work Policy

Work from office

74% employees reported

Monday to Saturday

50% employees reported

Strict timing

58% employees reported

Within city

42% employees reported

View detailed work policy

Top Employees Benefits

Health insurance

183 employees reported

Job/Soft skill training

171 employees reported

Cafeteria

71 employees reported

Office cab/shuttle

57 employees reported

View all benefits

About Havells

Founded in1983 (42 yrs old)

India Employee Count5k-10k

Global Employee Count5k-10k

India HeadquartersNoida, Uttar Pradesh, India

Office Locations

Websitehavells.com

Primary Industry

Other Industries

Are you managing Havells's employer brand? To edit company information,

claim this page for free

View in video summary

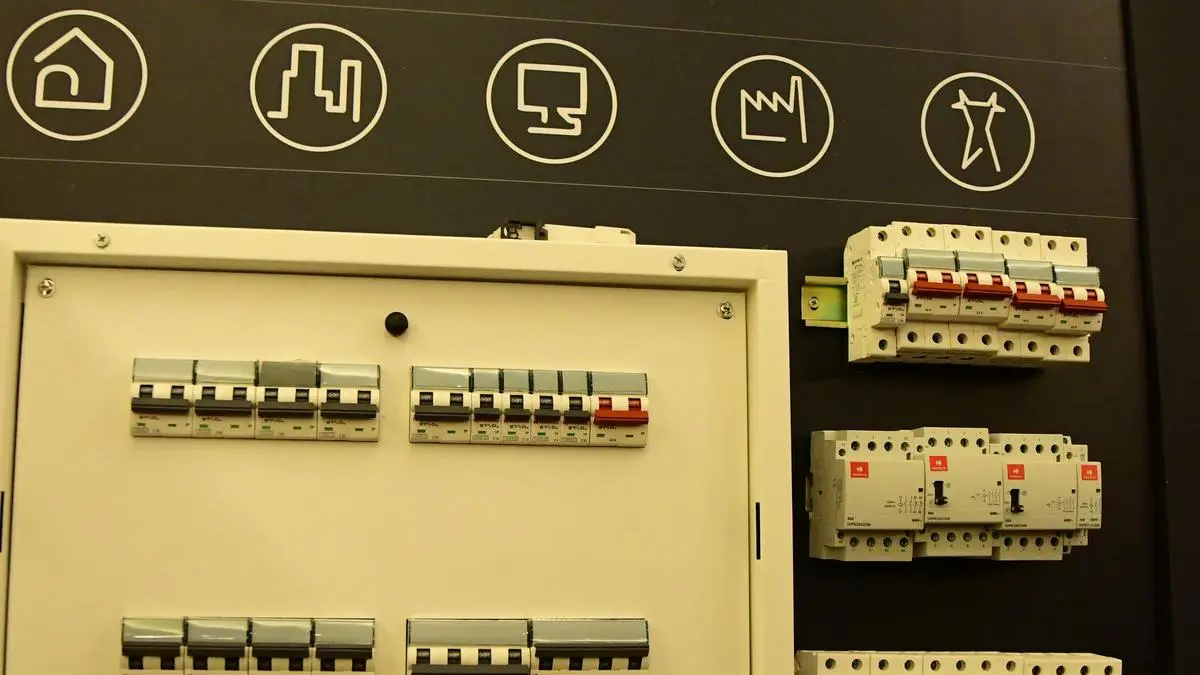

Havells India Limited is a leading Fast Moving Electrical Goods (FMEG) Company and a major power distribution equipment manufacturer with a strong global presence. Havells enjoys enviable market dominance across a wide spectrum of products, including Industrial & Domestic Circuit Protection Devices, Cables & Wires, Motors, Fans, Modular Switches, Home Appliances, Air Conditioners, Electric Water Heaters, Power Capacitors, Luminaires for Domestic, Commercial and Industrial Applications.

Mission: To achieve our vision through business ethics, global reach, technological expertise, building long-term relationships with all our associates, customers, partners and employees.

Vision: To be a globally recognised corporation for excellence, governance, consumer delight and fairness to each stakeholder including the society and environment we operate in.

Report error

Managing your company's employer brand?

Claim this Company Page for FREE

Brands of Havells

Crabtree

-

• No Reviews

Havells Ratings

based on 4k reviews

Overall Rating

3.9/5

How AmbitionBox ratings work?

5

1.9k

4

1k

3

515

2

186

1

310

Category Ratings

3.8

Salary

3.8

Work-life balance

3.7

Company culture

3.7

Job security

3.7

Skill development

3.6

Work satisfaction

3.4

Promotions

Havells is rated 3.9 out of 5 stars on AmbitionBox, based on 4k company reviews.This rating reflects an average employee experience, indicating moderate satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at Havells

based on 3.8k reviews

3.7

Rated by 173 Women

Rated 3.7 for Work-life balance and 3.7 for Job security

3.9

Rated by 3.6k Men

Rated 3.8 for Work-life balance and 3.8 for Salary

Work Policy at Havells

based on 566 reviews in last 6 months

Work from office

74%

Hybrid

19%

Permanent work from home

7%

Havells Reviews

Top mentions in Havells Reviews

+ 5 more

Compare Havells with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 3.9/5 based on 4k reviews | 3.9/5 based on 1.5k reviews | 4.2/5 based on 844 reviews | 4.0/5 based on 891 reviews |

Highly Rated for | Work-life balance Salary | Job security | Salary Job security Work-life balance | Job security Work-life balance Company culture |

Critically Rated for |  No critically rated category | Promotions |  No critically rated category | Promotions |

Primary Work Policy | Work from office 74% employees reported | Work from office 86% employees reported | Work from office 84% employees reported | Work from office 74% employees reported |

Rating by Women Employees | 3.7 Good rated by 173 women | 4.1 Good rated by 97 women | 3.9 Good rated by 16 women | 3.5 Good rated by 45 women |

Rating by Men Employees | 3.9 Good rated by 3.6k men | 3.9 Good rated by 1.3k men | 4.2 Good rated by 794 men | 4.0 Good rated by 809 men |

Job security | 3.7 Good | 3.9 Good | 4.0 Good | 4.0 Good |

View more

Havells Salaries

Havells salaries have received with an average score of 3.8 out of 5 by 4k employees.

Deputy Manager

(641 salaries)

Unlock

₹10 L/yr - ₹17 L/yr

Senior Engineer

(440 salaries)

Unlock

₹5.4 L/yr - ₹12 L/yr

Rural Sales Officer

(230 salaries)

Unlock

₹2.3 L/yr - ₹4.8 L/yr

Assistant General Manager

(210 salaries)

Unlock

₹22 L/yr - ₹40 L/yr

Senior Sales Executive

(193 salaries)

Unlock

₹4 L/yr - ₹9.1 L/yr

Area Head

(190 salaries)

Unlock

₹8.8 L/yr - ₹15.5 L/yr

Area Sales Manager

(188 salaries)

Unlock

₹8 L/yr - ₹13.8 L/yr

Sales Executive

(186 salaries)

Unlock

₹1.7 L/yr - ₹5.7 L/yr

Sales Officer

(141 salaries)

Unlock

₹2 L/yr - ₹5.2 L/yr

Sales Manager

(137 salaries)

Unlock

₹11.3 L/yr - ₹20.4 L/yr

Havells Interview Questions

Havells Jobs

Current Openings

Havells News

View all

Havells India Sees Solar Business Crossing Rs 1,500 Crore In Next Couple Of Years

- Havells India's solar business is expected to surpass Rs 1,500 crore in the next couple of years.

- The company invested Rs 600 crore in PV module manufacturer Goldi Solar in the first quarter to boost its presence in renewable energy.

- Havells India Chairman Ani Rai Gupta sees significant growth potential in the solar segment.

- Despite a decrease in Q1FY26 revenue and profit, Havells expects improvement in revenue and margin over the coming quarters.

Bloomberg Quint | 11 Aug, 2025

Five Stocks To Buy: Havells India, Aarti Industries, Medi Assist Healthcare Services, PI Industries, Coforge

- Stocks recommended by analysts for today's trade include Havells India, Aarti Industries, Medi Assist Healthcare Services, PI Industries, and Coforge.

- Analysts like Kunal Rambhia, Gaurav Sharma, and Ajit Mishra have shared views on these stocks.

- Recommendations and target prices for each stock are provided, along with analyst consensus and ratings.

- Given the detailed analysis and recommendations, this article is eligible for web story generation.

Bloomberg Quint | 31 Jul, 2025

Havells India Expects Decent Growth Across Categories With Focus On Expansion, Says MD Anil Rai Gupta

- Havells India expects steady growth across all business categories and plans to focus on capacity expansion and exploring new geographies, according to MD Anil Rai Gupta.

- The company recently invested surplus cash in renewable energy capacity and secured a supply chain for solar energy expansion.

- Havells India will be investing around Rs 2,000 crore in its inorganic businesses next year and has undertaken capacity expansion in the underground cable segment.

- Inventory clearance has been slower this year compared to last year, with challenges in the summer product demand, but the company anticipates an improvement in the second half.

Bloomberg Quint | 22 Jul, 2025

Oberoi Realty, PNB Housing Finance, AGI Greenpac — Stocks React To Q1 Results

- Shares of Oberoi Realty Ltd., PNB Housing Finance Ltd., AGI Greenpac Ltd., and Havells India Ltd. reacted to their first-quarter results, with PNB Housing, AGI Greenpac, Havells India, and CIE Automotive shares trading higher early in the session.

- Key highlights of the Q1FY26 results include Oberoi Realty's revenue down by 29.7%, Ebitda down by 36.2%, and Net Profit down by 27.9% YoY; PNB Housing Finance's Net Profit down by 6.2%, and Total income up by 13.6% YoY; AGI Greenpac's Revenue down by 2.4%, Ebitda down by 7.9%, and Net Profit down by 7.1% QoQ; Havells India's Revenue down by 6%, EBITDA down by 9.9%, and Net Profit down by 14.8% YoY.

- Sagar Cement, Oberoi Realty, Parag Milk, and DCM Shriram experienced a decline post-results, while the companies mentioned earlier saw an increase in their stock value.

- The article is eligible for web story generation as it provides insights into how various company stocks reacted to their Q1 results, highlighting key financial data of Oberoi Realty, PNB Housing Finance, AGI Greenpac, and Havells India.

Bloomberg Quint | 22 Jul, 2025

'Buy' UltraTech, Can Fin Homes, Mastek; 'Add' Havells, JK Cement Says HDFC Securities Post Q1 Results

- HDFC Securities recommends 'Buy' on UltraTech Cement, Mastek, and Can Fin Homes, and 'Add' on JK Cement and Havells India based on Q1 results.

- UltraTech Cement is expected to see volume growth and margin improvement, with a target price of Rs 12,800.

- Havells India faced a decline in revenue but showed growth in certain segments; management is optimistic about demand picking up in the second half of FY26.

- JK Cement continues strong performance with projected volume growth and a revised target price of Rs 6,125; the company is well-positioned to achieve its capacity targets.

Bloomberg Quint | 22 Jul, 2025

Havells Q1 Results Review: Yes Securities Upgrades Stock To 'Add', Revises Target Price

- Yes Securities has upgraded Havells India Ltd.'s stock to 'Add' with a revised target price of Rs 1,716.

- In the medium to long term, Yes Securities believes that Havells should be bought on dips as the company is expected to improve its margin and command higher valuation.

- The brokerage foresees potential margin improvement in Havells' core business and cost-effective initiatives in its Lloyds segment.

- Havells' Q1 Ebitda margin at 9.6% was lower than estimates, but the company is expected to bounce back with real estate demand and improved sentiments for festive demand.

Bloomberg Quint | 22 Jul, 2025

Havells India Share Price Marginally Up After Q1 Results

- Havells India Ltd. shares rose marginally in early trade following the company's Q1 earnings report.

- The standalone net profit for the quarter decreased by 14% to Rs 352.3 crore compared to the year-ago period.

- Revenue from operations declined by 6% to Rs 5,437.8 crore, below the estimated Rs 6,049 crore.

- Analysts mentioned that Havells India's core business was in line, but Lloyds segment disappointed. The stock has fallen 13% in the last 12 months.

Bloomberg Quint | 22 Jul, 2025

Havells consolidated net profit down 15%

- Havells reported a 15% decrease in consolidated net profit, attributing it to a tepid summer affecting cooling product sales compared to the previous year.

- The company highlighted subdued consumer demand but noted growth in industrial-infra demand. Cost discipline helped control expense growth, mitigating the impact of revenue decline on net profitability.

- Havells experienced robust volume growth in cable and wire segments, driven by capacity expansion and strong industrial infra demand. However, lighting revenue declined due to a 10% LED price deflation.

- Unfavorable weather conditions, including unseasonal rains and a shorter summer season, impacted demand for fans and air coolers. The performance of Lloyd was also affected by the weak summer season compared to the previous year.

HinduBusinessLine | 21 Jul, 2025

Havells, Dixon, PG Electroplast — Nirmal Bang's Top Stock Picks In Consumer Durables; Q1 Results Preview

- Nirmal Bang's top stock picks in consumer durables include Havells, Dixon, and PG Electroplast.

- Consumer durables and consumer electricals are expected to witness margin contractions, with specific companies expected to outperform on both revenue and profitability.

Bloomberg Quint | 14 Jul, 2025

F&O Query: Should you hold call options on Havells India & CONCOR?

- Havells India stock saw a decline but remains within the range of ₹1,500-1,600 since early May, making the next trend uncertain.

- Support levels at ₹1,500-1,515 with a possible rebound. A rally towards ₹1,600 is anticipated in the near-term.

- Suggestion to exit Havells India trade at ₹40 and consider buying call options again once the stock breaks out of ₹1,600, potentially rising to ₹1,670.

- CONCOR stock bounced off its 50-day moving average and surpassed a barrier at ₹612, showing a positive outlook and potential rise to ₹650 before the expiry.

HinduBusinessLine | 12 Jul, 2025

Powered by

Havells Subsidiaries

Lloyd Electric & Engineering

3.9

• 130 reviews

Lloyd

4.1

• 81 reviews

Promptec Renewable Energy Solutions

4.7

• 12 reviews

Standard Electricals

4.4

• 9 reviews

Report error

Compare Havells with

BHEL

4.1

CG Power and Industrial Solutions

3.9

C&S Electric

4.0

KEI Industries

4.2

RR kabel

4.0

Finolex Cables

3.7

Amber Enterprises India

3.9

HBL Power Systems

4.0

Legrand

3.6

Landis+Gyr

3.0

Bharat Bijlee

4.3

Elecon Engineering

4.1

Lumino Industries

3.8

East India Udyog

4.0

Servotech Power Systems

4.1

Kirloskar Electric Company

3.5

Schneider Electric Infrastructure

4.2

SasMos HET Technologies

3.8

Triveni Turbines

3.7

Swelect Energy Systems

3.8

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Companies Similar to Havells

CG Power and Industrial Solutions

Consumer goods, Manufacturing, Education & Training, Electrical Equipment

3.9

• 1.5k reviews

C&S Electric

Manufacturing, Electronics, Engineering & Construction, Electrical Equipment

4.0

• 891 reviews

KEI Industries

Manufacturing, Electronics, Electrical Equipment

4.2

• 844 reviews

RR kabel

Industrial Machinery, Manufacturing, Electrical Equipment

4.0

• 704 reviews

Finolex Cables

Plastics / Rubber, Electrical Equipment

3.7

• 690 reviews

Amber Enterprises India

Internet, Electrical Equipment

3.9

• 650 reviews

HBL Power Systems

Manufacturing, Electronics, Electrical Equipment

4.0

• 540 reviews

Landis+Gyr

Internet, Manufacturing, Electronics, Software Product, Electrical Equipment

3.0

• 433 reviews

Bharat Bijlee

Manufacturing, Electronics, Engineering & Construction, Electrical Equipment

4.3

• 410 reviews

Elecon Engineering

Engineering & Construction, Electrical Equipment

4.1

• 339 reviews

Lumino Industries

Manufacturing, Electronics, Electrical Equipment

3.8

• 307 reviews

East India Udyog

Manufacturing, Power, Electrical Equipment

4.0

• 261 reviews

Havells FAQs

When was Havells founded?

Havells was founded in 1983. The company has been operating for 42 years primarily in the Electrical Equipment sector.

Where is the Havells headquarters located?

Havells is headquartered in Noida, Uttar Pradesh. It operates in 8 cities such as Noida, Bangalore / Bengaluru, Lucknow, Chennai, Ahmedabad. To explore all the office locations, visit Havells locations.

How many employees does Havells have in India?

Havells currently has more than 7,400+ employees in India. Sales & Business Development department appears to have the highest employee count in Havells based on the number of reviews submitted on AmbitionBox.

Does Havells have good work-life balance?

Havells has a Work-Life Balance Rating of 3.8 out of 5 based on 3,900+ employee reviews on AmbitionBox. 74% employees rated Havells 4 or above, while 26% employees rated it 3 or below on work-life balance. This indicates that the majority of employees feel a generally balanced work-life experience, with some opportunities for improvement based on the feedback. We encourage you to read Havells work-life balance reviews for more details.

Is Havells good for career growth?

Career growth at Havells is rated as moderate, with a promotions and appraisal rating of 3.4. 26% employees rated Havells 3 or below, while 74% employees rated it 4 or above on promotions / appraisal. This rating suggests that while some employees view growth opportunities favorably, there is scope for improvement based on employee feedback. We recommend reading Havells promotions / appraisals reviews for more detailed insights.

What are the pros and cons of working in Havells?

Working at Havells comes with several advantages and disadvantages. It is highly rated for salary & benefits and work life balance. However, it is poorly rated for promotions / appraisal, work satisfaction and skill development, based on 3,900+ employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Trusted by over 1.5 Crore job seekers to find their right fit company

85 Lakh+

Reviews

10L+

Interviews

4 Crore+

Salaries

1.5 Cr+

Users

Contribute to help millions

AmbitionBox Awards

Get AmbitionBox app