Add office photos

Engaged Employer

JPMorgan Chase & Co.![]()

3.9

based on 6.7k Reviews

Video summary

Proud winner of ABECA 2025 - AmbitionBox Employee Choice Awards

Company Overview

Associated Companies

Company Locations

Working at JPMorgan Chase & Co.

Company Summary

J.P Morgan is a global leader in financial services offering solutions to the world's most important corporations, governments and institutions.

Overall Rating

3.9/5

based on 6.7k reviews

3% above

industry average

Highly rated for

Job security, Company culture, Salary

Critically rated for

Promotions

Work Policy

Hybrid

52% employees reported

Monday to Friday

87% employees reported

Flexible timing

64% employees reported

No travel

76% employees reported

View detailed work policy

Top Employees Benefits

Office cab/shuttle

764 employees reported

Cafeteria

633 employees reported

Job/Soft skill training

513 employees reported

Health insurance

505 employees reported

View all benefits

About JPMorgan Chase & Co.

Founded in1968 (57 yrs old)

India Employee Count50k-1 Lakh

Global Employee Count1 Lakh+

HeadquartersNew York, New York, United States (USA)

Office Locations

Websitejpmorganchase.com

Primary Industry

Other Industries

--

View in video summary

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm with assets of $3.7 trillion and operations worldwide. The firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the firm serves millions of customers, predominantly in the U.S., and many of the world’s most prominent corporate, institutional and government clients globally.

We put our customers first, building with their needs in mind, providing worldclass service and growing to reach people, businesses and communities everywhere. We take pride in what we do and care deeply about our customers, communities and each other. We have a culture of teamwork, trust, humanity and humility. We create space for people to bring their full selves to work. We’re distinguished by our capacity to imagine and build. Our innovations are powered by a deep understanding of our customers and clients.

We bring our capabilities and experience to bear on the toughest challenges in the world. We lead with expertise, foresight and fortitude to deliver exceptional results. We face facts and make disciplined decisions grounded in data, with a long-term view. We strive to stand up for what we believe in and do the right thing. Our quality and rigor at scale are unmatched. We attract world-class talent and create an environment where they can thrive. We set high expectations, commit to strong performance and hold ourselves accountable to the highest standards of integrity.

We put our customers first, building with their needs in mind, providing worldclass service and growing to reach people, businesses and communities everywhere. We take pride in what we do and care deeply about our customers, communities and each other. We have a culture of teamwork, trust, humanity and humility. We create space for people to bring their full selves to work. We’re distinguished by our capacity to imagine and build. Our innovations are powered by a deep understanding of our customers and clients.

We bring our capabilities and experience to bear on the toughest challenges in the world. We lead with expertise, foresight and fortitude to deliver exceptional results. We face facts and make disciplined decisions grounded in data, with a long-term view. We strive to stand up for what we believe in and do the right thing. Our quality and rigor at scale are unmatched. We attract world-class talent and create an environment where they can thrive. We set high expectations, commit to strong performance and hold ourselves accountable to the highest standards of integrity.

Mission: Our mission is to enable more people to contribute to and share in the rewards of a growing economy. We believe that reducing inequality and creating widely-shared prosperity requires the collaboration of business, government, nonprofits, and other civic organizations, particularly in the cities and metropolitan regions that power economic growth.

Vision: Our vision is simple and unchanged :- We aim to be the most respected financial services firm in the world, serving corporations and individuals. To that end, it is imperative that we run a healthy, vibrant and responsible company. In addition to traditional banking, we do a lot to help the communities in which we operate, which, in turn, provides the foundation for increased opportunity and prosperity for all. And just to note, while we are proud of the good things we do every day, we are also an organization that acknowledges the mistakes we make along the way, which is important to do. And when we do make mistakes, we own up to them, learn from them and then move on.

Report error

ABECA - AmbitionBox Employee Choice Awards

Awards 2025

Awards 2024

Best of the best, rated by employees

JPMorgan Chase & Co. won India’s Largest Employee Choice Awards in Mega Companies Category.

Top Rated Mega Company

Top Rated Financial Services Company

Share

JPMorgan Chase & Co. Ratings

based on 6.7k reviews

Overall Rating

3.9/5

How AmbitionBox ratings work?

5

3.3k

4

1.8k

3

789

2

325

1

528

Category Ratings

4.0

Job security

3.8

Company culture

3.8

Salary

3.8

Skill development

3.7

Work-life balance

3.5

Work satisfaction

3.3

Promotions

JPMorgan Chase & Co. is rated 3.9 out of 5 stars on AmbitionBox, based on 6.7k company reviews.This rating reflects an average employee experience, indicating moderate satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at JPMorgan Chase & Co.

based on 6.4k reviews

3.9

Rated by 2.3k Women

Rated 4.0 for Job security and 3.7 for Company culture

4.0

Rated by 4.1k Men

Rated 4.0 for Job security and 3.9 for Salary

Work Policy at JPMorgan Chase & Co.

based on 1.1k reviews in last 6 months

Hybrid

52%

Work from office

46%

Permanent work from home

2%

JPMorgan Chase & Co. Reviews

Top mentions in JPMorgan Chase & Co. Reviews

+ 5 more

Compare JPMorgan Chase & Co. with Similar Companies

Change Company | Change Company | Change Company | ||

|---|---|---|---|---|

Overall Rating | 3.9/5 based on 6.7k reviews | 3.8/5 based on 7.1k reviews | 3.9/5 based on 5.3k reviews | 4.0/5 based on 10.3k reviews |

Highly Rated for | Job security Skill development Salary | Work-life balance Job security | Job security Work-life balance Company culture | Salary Skill development Job security |

Critically Rated for | Promotions | Promotions Skill development | Promotions | No critically rated category |

Primary Work Policy | Hybrid 52% employees reported | Hybrid 85% employees reported | Hybrid 84% employees reported | Work from office 77% employees reported |

Rating by Women Employees | 3.9 Good rated by 2.3k women | 3.9 Good rated by 2.2k women | 3.9 Good rated by 1.7k women | 3.8 Good rated by 919 women |

Rating by Men Employees | 4.0 Good rated by 4.1k men | 3.8 Good rated by 4.6k men | 4.0 Good rated by 3.3k men | 4.0 Good rated by 8.9k men |

Job security | 4.0 Good | 3.9 Good | 4.0 Good | 3.8 Good |

View more

JPMorgan Chase & Co. Salaries

JPMorgan Chase & Co. salaries have received with an average score of 3.8 out of 5 by 6.7k employees.

Team Lead

(5.8k salaries)

Unlock

₹4.5 L/yr - ₹17 L/yr

Analyst

(2.8k salaries)

Unlock

₹6.5 L/yr - ₹26.9 L/yr

Software Engineer

(2.8k salaries)

Unlock

₹11.2 L/yr - ₹36 L/yr

Senior Associate

(2.6k salaries)

Unlock

₹14 L/yr - ₹52 L/yr

Assistant Vice President

(2.3k salaries)

Unlock

₹16 L/yr - ₹52.1 L/yr

Associate Vice President

(2.3k salaries)

Unlock

₹16.6 L/yr - ₹50 L/yr

Operations Analyst

(1.5k salaries)

Unlock

₹2.8 L/yr - ₹10.2 L/yr

Senior Software Engineer

(1.3k salaries)

Unlock

₹14.3 L/yr - ₹50 L/yr

Financial Analyst

(1.1k salaries)

Unlock

₹5 L/yr - ₹19 L/yr

Associate Software Engineer

(975 salaries)

Unlock

₹13 L/yr - ₹42 L/yr

JPMorgan Chase & Co. Interview Questions

A Software Developer was asked 11mo agoQ. Given a Python program, debug the program.

An Associate was asked 11mo agoQ. What requirements do you gather before creating a dashboard?

A Senior Software Engineer was asked 9mo agoQ. Implement the Factory design pattern.

A Software Developer Intern was asked Q. Count Subarrays with Given XOR Problem Statement You are given an arra...read more

A Full Stack Developer was asked Q. Write a Java 8 program to iterate through a Stream using the forEach m...read more

JPMorgan Chase & Co. Jobs

Popular Designations JPMorgan Chase & Co. Hires for

Popular Skills JPMorgan Chase & Co. Hires for

Current Openings

JPMorgan Chase & Co. News

View all

Stablecoin Regulation Gains Momentum as US Senate Approves GENIUS Act

- The U.S. Senate approved the GENIUS Act 68-30, advancing stablecoin regulation with bipartisan support.

- Legislation now moves to the House; the Trump administration sees stablecoins as crucial for U.S. economic competitiveness.

- Treasury Secretary projects the stablecoin market could reach $3.7 trillion, driving demand for tokenized U.S. Treasuries.

- The GENIUS Act aims to provide clarity and regulation for the rapidly growing stablecoin sector in the U.S.

- The bill will establish rules on reserve requirements, compliance, consumer protection, and stablecoin integration into the financial system.

- Stablecoin adoption is expected to grow significantly with potential market size projections of $3.7 trillion by the end of the decade.

- Following Senate approval, JPMorgan launched its stablecoin, JPMD, on Ethereum’s Layer 2 Base chain, backed by Coinbase Global.

- The passage of the GENIUS Act could lead to advancements in the U.S. central bank digital currency (CBDC) space, positioning the country as a global leader.

- The legislation is deemed a transformative moment for the digital asset economy and could redefine the future of finance in America.

TronWeekly | 18 Jun, 2025

U.S. Senate Overwhelmingly Supports Stablecoins’ GENIUS Act: Next to the House of Representatives

- The U.S. Senate passed the GENIUS Act for stablecoins with bipartisan support in a 68 to 30 vote.

- The legislation now moves to the U.S. House of Representatives for expected bipartisan approval.

- The Trump administration emphasizes the significance of crypto assets for the economy.

- The GENIUS Act aims to bring clarity and regulation to the stablecoins sector in the U.S.

- Passing the GENIUS Act could lead to mainstream adoption of the digital dollar.

- The U.S. Treasury Secretary sees the act as beneficial for the private sector, treasury, and consumers.

- It is projected that the stablecoins market could reach $3.7 trillion by the end of the decade.

- JPMorgan has introduced its JPMD stablecoin on Ethereum's L2 Base chain, supported by Coinbase Global.

Coinpedia | 18 Jun, 2025

U.S. Senate Passes GENIUS Act Stablecoin Regulations in Crypto First

- The U.S. Senate passed the GENIUS Act, a stablecoin regulation bill, in a 68-30 vote, moving one step closer to President Trump's approval.

- Senate Banking Committee Chairman and House Committee on Financial Services Chairman express anticipation for regulatory clarity in the digital asset ecosystem.

- The bill must pass the House before reaching Trump's desk, with implications for the global adoption of dollar-backed digital currencies and blockchain technology.

- Financial institutions like JPMorgan, Bank of America, Wells Fargo, Citigroup, and Circle are increasingly interested in stablecoins as the industry gains legitimacy.

- Major retailers like Walmart and Amazon are exploring embedded payments with stablecoins, while global banks experiment with cross-border liquidity management.

- The GENIUS Act's passage aims to reduce legal risks, foster industry confidence, and promote stablecoin adoption and innovation in the financial services sector.

- Concerns include potential risks to traditional banks from liquidity flight into stablecoins and issues related to monetary sovereignty and surveillance.

- Regulations require stablecoins to be backed 1:1 by U.S. Treasuries and subject to audits/AML, but there are ongoing discussions about further safeguards.

- Lawmakers are considering merging the GENIUS Act with broader legislation like the CLARITY Act, which could impact implementation timelines.

- If passed, the GENIUS Act will set a precedent for how digital currencies are managed, signaling a new era in financial innovation governance.

Pymnts | 18 Jun, 2025

Senate passes GENIUS stablecoin bill, giving crypto industry first major legislative win

- The Senate passed the GENIUS Act, a bill that sets federal guardrails for stablecoins and allows private companies to issue digital dollars with government approval.

- The bill, approved with a 68-30 vote, is a significant win for the crypto industry.

- It requires full reserve backing, monthly audits, and AML compliance for stablecoins, and grants broad authority to Treasury Secretary Scott Bessent.

- Some senators criticized the bill for not addressing personal profit from digital assets, while others praised its consumer protection and innovation support.

- The GENIUS Act now moves to the House, where it will join the STABLE bill, differing on regulatory oversight and prohibited elements.

- Despite being aimed at stablecoins, the bill faced challenges, delayed negotiations, and bipartisan struggles during the passage process.

- Stablecoins, largely USD-pegged, offer faster settlements, lower fees, and are gaining traction in payment systems and financial institutions.

- Companies like Shopify and Bank of America are exploring stablecoin integrations, while JPMorgan launched a deposit token, JPMD, for institutional clients.

- The bill restricts tech giants from directly issuing stablecoins to address monopoly concerns, with Trump's disclosed crypto holdings reflecting significant wealth tied to digital assets.

- The legislation faced bipartisan disagreements over profit restrictions, highlighting the growing intersection of politics, technology, and finance in the crypto space.

CNBC | 18 Jun, 2025

Jamie Dimon has a solution to the skills shortage

- JPMorgan Chase CEO Jamie Dimon suggests that companies should invest in schools to address the skills gap in corporate America.

- Dimon highlights the need to incorporate workplace skills into school curriculums to prepare students for the demands of the business community.

- He emphasizes the importance of developing skills such as cyber, coding, programming, financial management, and project management.

- Dimon believes that partnering with schools and investing in education can help bridge the skills gap in the workforce.

- He advocates for schools to offer classes that provide credentials as part of the standard curriculum and not just as extra credit.

- JPMorgan already has programs for business management and technology skills, showcasing the company's commitment to addressing this issue.

- Dimon underscores the significance of schools adapting their curricula to include both traditional subjects and specialized workplace-focused skills.

- He mentions the need for more workplace training and financial education classes to better prepare students for the job market.

- Dimon stresses the role of businesses in solving skills shortage issues and highlights the importance of not solely relying on government intervention.

- Young people are facing challenges in finding employment across various educational levels due to factors like AI automation.

Insider | 18 Jun, 2025

2 status-symbol credit cards are getting new perks. Here's what $795 a year gets you with the Chase Sapphire Reserve.

- JPMorgan Chase is increasing the annual fee of the Sapphire Reserve credit card to $795, up from $550.

- American Express is updating its Platinum Card later this year with changes likely for its $695 yearly fee, but details are pending.

- Chase Sapphire Reserve and American Express Platinum Cards are popular among travelers and food enthusiasts.

- Chase Sapphire Reserve will offer enhanced travel perks, including 8x points on Chase Travel, 4x points on direct airline or hotel bookings.

- Cardholders can get up to $500 credit for Chase's hotel collection, IHG Platinum Elite status, and retain the $300 annual travel credit.

- A Points Boost feature will allow points to be worth up to 2x more on select hotel and flight redemptions.

- Dining perks include 3x points on dining and up to $300 annual dining credit for exclusive restaurant reservations.

- Lifestyle perks for Chase Sapphire Reserve cardholders include Apple TV+ and Apple Music subscriptions, Peloton credits, and entertainment ticket credits.

- The card also offers DoorDash and Lyft perks, which remain unchanged.

- Some lifestyle perks require activation by the cardholders.

- For a detailed list of new benefits with the Chase Sapphire Reserve card, refer to the original Business Insider article.

Insider | 18 Jun, 2025

Chainlink Co-Founder: Wave of New Stablecoins Will Rely on LINK Infrastructure

- Chainlink's co-founder discussed the importance of U.S. stablecoin regulations for global stablecoin adoption.

- Regulatory clarity in the U.S. is expected to lead to a wave of new stablecoins worldwide, requiring proof of reserves and cross-chain connectivity.

- Chainlink offers a platform integrating proof of reserves and cross-chain connectivity, essential for stablecoin reliability in the digital asset economy.

- Seamless interoperability, compliance, and identity management are critical as blockchain transactions become more complex.

- Chainlink's platform aims to address these challenges, positioning it as a unified solution for stablecoin management.

- Chainlink is also working on integrating on-chain identity and compliance requirements into its platform.

- JPMorgan Chase's trademark filing for 'JPMD' indicates its interest in expanding blockchain offerings, including stablecoin initiatives.

- Growing institutional interest in stablecoins is evident, with new regulations like the GENIUS Act expected to provide a structured framework for the market.

- The regulatory landscape could see the stablecoin sector expand to $2 trillion by 2028, fostering adoption in decentralized finance and other sectors.

- Arthur Hayes warns of a potential 'stablecoin mania' with overhyped firms flooding the market and facing risks due to poor financial engineering.

- Despite concerns, institutional interest persists, and the stablecoin market shows potential growth as regulations evolve.

Crypto-News-Flash | 18 Jun, 2025

MakeMyTrip seeks over $2 billion in shares, convertible sale

- MakeMyTrip is seeking over $2 billion through the sale of new shares and convertible bonds.

- The company is offering 14 million new shares and aiming to raise $1.25 billion from zero-coupon convertible bonds.

- At MakeMyTrip's closing price on Monday, the shares would be valued at $1.4 billion.

- Hong Kong- and New York-traded Trip.com holds 45.34% voting power in MakeMyTrip, which is set to reduce to 19.99% after the share sale.

- MakeMyTrip, founded in 2000, offers online booking services for flights, hotels, travel packages, and more.

- The convertible bonds are offered with a conversion premium of 25% to 35%.

- The offerings are expected to price after the US markets close on Tuesday.

- Morgan Stanley and JPMorgan Chase & Co are leading the share sale.

- MakeMyTrip stated it is a 'proud Indian company' following security concerns raised over defense personnel booking tickets on the platform.

- The company did not immediately respond to a request for comment.

- The news was published on June 17, 2025.

HinduBusinessLine | 17 Jun, 2025

AI Hiring Is Exploding: Wall Street Led the Charge, Now Everyone’s Building In-House

- Financial firms like JPMorgan and Goldman Sachs were early investors in AI, sparking a trend for in-house AI teams across industries.

- AI skills are becoming crucial for engineers, leading to new roles and reshaped workflows.

- The Mayo Clinic, Walmart, Tesla, and tech giants like Microsoft and Salesforce are investing in AI technology.

- In-demand skills for AI engineers include Python, TensorFlow, PyTorch, cloud architecture, and MLOps.

- AI is changing the hiring funnel with trends like LLM-based candidate matching and AI-driven assessments.

- Engineers are encouraged to make their resumes machine-readable and leverage AI tools for career advancement.

- Engineers specializing in genAI can earn high salaries, benefit from remote roles, and witness career growth.

- AI fluency is essential for engineers to drive innovation and stay ahead in the evolving job market.

- To future-proof their careers, engineers should upskill, build AI projects, optimize resumes, follow trends, and use AI tools daily.

- The AI hiring trend is here to stay, and engineers must adapt by blending strong fundamentals with AI expertise.

Hackernoon | 16 Jun, 2025

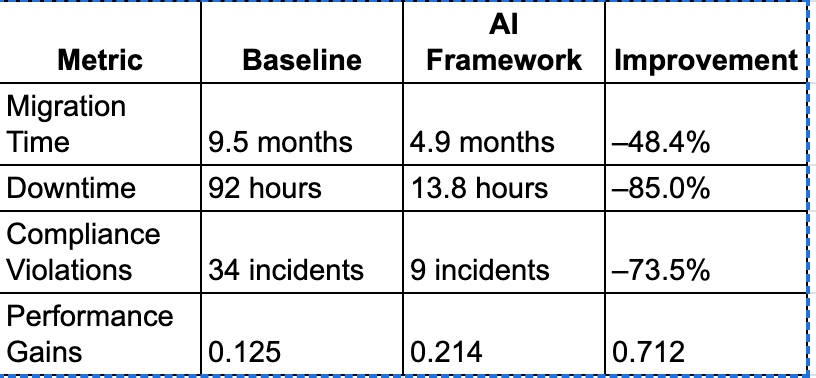

An AI-Powered Framework for Scalable Cloud Migration in Financial Services and Critical…

- Legacy IT systems in financial services and critical infrastructure sectors pose challenges for cloud migration due to complex architectures, regulations, and risks.

- An AI-driven framework is introduced to automate and optimize cloud migration in mission-critical environments.

- The framework utilizes transformer-based code analysis, graph neural network dependency mapping, and NLP for compliance simulation.

- It reduces migration time, downtime, and compliance violations, improving operational resilience and modernization.

- Evaluations with JPMorgan Chase, Bank of America, Capital One, and Citi show positive results in legacy modernization.

- AI-assisted migration enables secure, compliant, and efficient modernization aligned with business demands.

- Financial institutions and critical infrastructure are undergoing digital transformation using cloud computing for scalability and cost efficiency.

- Legacy IT systems consist of millions of lines of COBOL, PL/SQL, or proprietary code, making migration challenging.

Medium | 16 Jun, 2025

Powered by

JPMorgan Chase & Co. Subsidiaries

JP Morgan Securities

4.3

• 19 reviews

Chase Bank

3.6

• 14 reviews

WePay

1.0

• 1 review

Report error

JPMorgan Chase & Co. Offices

Compare JPMorgan Chase & Co. with

Morgan Stanley

3.6

Goldman Sachs

3.5

TCS

3.6

Bank of America

4.2

Amazon

4.0

Google

4.4

Accenture

3.8

Deloitte

3.8

Deutsche Bank

3.8

Oracle

3.7

Capgemini

3.7

Barclays

3.8

Infosys

3.6

Microsoft Corporation

3.9

Cholamandalam Investment & Finance

3.9

Citicorp

3.7

BNY

3.8

American Express

4.1

State Street Corporation

3.7

Motilal Oswal Financial Services

3.6

Contribute & help others!

You can choose to be anonymous

Companies Similar to JPMorgan Chase & Co.

Bajaj Finserv

Banking / Insurance / Accounting, Financial Services, FinTech

4.0

• 10.3k reviews

Wells Fargo

Financial Services

3.8

• 7.1k reviews

HSBC Group

Financial Services, IT Services & Consulting

3.9

• 5.3k reviews

Cholamandalam Investment & Finance

Financial Services

3.9

• 5.1k reviews

American Express

Financial Services, Retail, Travel & Tourism / Hospitality

4.1

• 3.4k reviews

State Street Corporation

Financial Services, Internet

3.7

• 3.3k reviews

Motilal Oswal Financial Services

Financial Services

3.6

• 3.2k reviews

UBS

Financial Services

3.9

• 3.1k reviews

HDFC Sales

Financial Services

4.0

• 2.6k reviews

IDFC FIRST Bharat

Financial Services

4.4

• 2.5k reviews

JPMorgan Chase & Co. FAQs

When was JPMorgan Chase & Co. founded?

JPMorgan Chase & Co. was founded in 1968. The company has been operating for 57 years primarily in the Financial Services sector.

Where is the JPMorgan Chase & Co. headquarters located?

JPMorgan Chase & Co. is headquartered in New York, New York. It operates in 3 cities such as Bangalore / Bengaluru, Mumbai, Hyderabad / Secunderabad. To explore all the office locations, visit JPMorgan Chase & Co. locations.

How many employees does JPMorgan Chase & Co. have in India?

JPMorgan Chase & Co. currently has more than 55,000+ employees in India. Engineering - Software & QA department appears to have the highest employee count in JPMorgan Chase & Co. based on the number of reviews submitted on AmbitionBox.

Does JPMorgan Chase & Co. have good work-life balance?

JPMorgan Chase & Co. has a Work-Life Balance Rating of 3.7 out of 5 based on 6,700+ employee reviews on AmbitionBox. 76% employees rated JPMorgan Chase & Co. 4 or above, while 24% employees rated it 3 or below on work-life balance. This indicates that the majority of employees feel a generally balanced work-life experience, with some opportunities for improvement based on the feedback. We encourage you to read JPMorgan Chase & Co. work-life balance reviews for more details.

Is JPMorgan Chase & Co. good for career growth?

Career growth at JPMorgan Chase & Co. is rated as moderate, with a promotions and appraisal rating of 3.3. 24% employees rated JPMorgan Chase & Co. 3 or below, while 76% employees rated it 4 or above on promotions / appraisal. This rating suggests that while some employees view growth opportunities favorably, there is scope for improvement based on employee feedback. We recommend reading JPMorgan Chase & Co. promotions / appraisals reviews for more detailed insights.

What are the pros and cons of working in JPMorgan Chase & Co.?

Working at JPMorgan Chase & Co. comes with several advantages and disadvantages. It is highly rated for job security, company culture and salary & benefits. However, it is poorly rated for promotions / appraisal, work satisfaction and work life balance, based on 6,700+ employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Trusted by over 1.5 Crore job seekers to find their right fit company

80 Lakh+

Reviews

10L+

Interviews

4 Crore+

Salaries

1.5 Cr+

Users

Contribute to help millions

AmbitionBox Awards

Get AmbitionBox app