Add office photos

Employer?

Claim Account for FREE

TransUnion![]()

3.9

based on 520 Reviews

Video summary

Company Overview

Company Locations

Working at TransUnion

Company Summary

A global organization enhancing operational capabilities through local talent in data analytics, business process management, and technology support.

Overall Rating

3.9/5

based on 520 reviews

5% above

industry average

Highly rated for

Company culture, Salary, Work-life balance

Critically rated for

Promotions

Work Policy

Hybrid

90% employees reported

Monday to Friday

87% employees reported

Flexible timing

82% employees reported

No travel

74% employees reported

View detailed work policy

Top Employees Benefits

Health insurance

35 employees reported

Job/Soft skill training

32 employees reported

Cafeteria

20 employees reported

Professional degree assistance

11 employees reported

View all benefits

About TransUnion

Founded in1968 (57 yrs old)

India Employee Count1k-5k

Global Employee Count10k-50k

HeadquartersChicago, Illinois, United States

Office Locations

--

Websitetransunion.in

Primary Industry

Other Industries

Are you managing TransUnion's employer brand? To edit company information,

claim this page for free

View in video summary

Enabling TransUnion with robust scale and scope while improving efficiencies and effectiveness, strengthening operational resilience, and augmenting our existing service offerings. Our GCCs in Bengaluru, Chennai, Hyderabad and Pune leverage local talent to deliver TransUnion’s core capabilities and support global operations with scale and speed. We’re creating opportunities across a full stack of competencies with contact center, business process management, technology support and transformation, and data analytics roles. This enables TransUnion to expand our time zone and language coverage — ultimately enabling thriving economies around the world.

Report error

Managing your company's employer brand?

Claim this Company Page for FREE

TransUnion Ratings

based on 520 reviews

Overall Rating

3.9/5

How AmbitionBox ratings work?

5

236

4

158

3

49

2

33

1

44

Category Ratings

4.0

Company culture

4.0

Salary

4.0

Work-life balance

3.7

Job security

3.7

Work satisfaction

3.6

Skill development

3.2

Promotions

TransUnion is rated 3.9 out of 5 stars on AmbitionBox, based on 520 company reviews.This rating reflects an average employee experience, indicating moderate satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at TransUnion

based on 500 reviews

3.9

Rated by 110 Women

Rated 3.9 for Company culture and 3.9 for Salary

4.0

Rated by 390 Men

Rated 4.1 for Work-life balance and 4.0 for Company culture

Work Policy at TransUnion

based on 127 reviews in last 6 months

Hybrid

90%

Work from office

6%

Permanent work from home

4%

TransUnion Reviews

Top mentions in TransUnion Reviews

+ 5 more

Compare TransUnion with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 3.9/5 based on 520 reviews | 3.2/5 based on 8.1k reviews | 2.9/5 based on 2.6k reviews | 3.9/5 based on 5.9k reviews |

Highly Rated for | Work-life balance Salary Company culture |  No highly rated category |  No highly rated category | Work-life balance Company culture |

Critically Rated for | Promotions | Job security Company culture Promotions | Promotions Company culture Work satisfaction | Promotions |

Primary Work Policy | Hybrid 90% employees reported | Work from office 51% employees reported | Work from office 92% employees reported | Hybrid 75% employees reported |

Rating by Women Employees | 3.9 Good rated by 110 women | 3.2 Average rated by 674 women | 2.9 Poor rated by 640 women | 3.9 Good rated by 1.4k women |

Rating by Men Employees | 4.0 Good rated by 390 men | 3.2 Average rated by 7k men | 2.9 Poor rated by 1.8k men | 3.9 Good rated by 4.2k men |

Job security | 3.7 Good | 2.7 Poor | 2.8 Poor | 3.7 Good |

View more

TransUnion Salaries

TransUnion salaries have received with an average score of 4.0 out of 5 by 520 employees.

Senior Analyst

(272 salaries)

Unlock

₹12 L/yr - ₹20.9 L/yr

Analyst

(247 salaries)

Unlock

₹5.5 L/yr - ₹12.9 L/yr

Developer Associate

(174 salaries)

Unlock

₹6 L/yr - ₹14.3 L/yr

Senior Developer

(114 salaries)

Unlock

₹18.4 L/yr - ₹31.5 L/yr

Software Developer

(110 salaries)

Unlock

₹11.3 L/yr - ₹20 L/yr

Senior Engineer

(95 salaries)

Unlock

₹20.1 L/yr - ₹34.5 L/yr

Senior Consultant

(81 salaries)

Unlock

₹23.4 L/yr - ₹43 L/yr

Associate Engineer

(79 salaries)

Unlock

₹6.1 L/yr - ₹13.8 L/yr

Lead Developer

(74 salaries)

Unlock

₹27.1 L/yr - ₹43 L/yr

Data Engineer

(68 salaries)

Unlock

₹8.4 L/yr - ₹15.1 L/yr

TransUnion Interview Questions

A Senior Analyst was asked 11mo agoQ. What are the key differences between C and C++?

A Test Engineer was asked 9mo agoQ. What is regression testing?

A Java Full Stack Developer was asked Q. How do you compare two objects of the same class using equals and hash...read more

A Java Developer was asked Q. What is a static initializer?

A Data Scientist was asked 8mo agoQ. How to treat multicollinearity, imbalanced dataset

TransUnion Jobs

Popular Skills TransUnion Hires for

Current Openings

TransUnion News

View all

TransUnion Reveals 60% UK Adults Like Using BNPL Due to Its Simplicity

- TransUnion findings show 26% UK adults prefer BNPL over credit cards for daily spending.

- 60% like BNPL's simplicity, with young adults using it for small purchases.

- Some rely on BNPL for groceries, petrol, travel, and school supplies.

- Upcoming regulations aim to enforce affordability checks on BNPL loans.

The Fintech Times | 30 Jun, 2025

Buy now, pay later loans will soon hit credit scores — and experts think Gen Z could be at risk

- FICO will include buy now, pay later (BNPL) data in credit scores starting this fall.

- BNPL loans have become popular, especially among Gen Z, raising concerns about credit score impacts.

- Including BNPL data will be challenging as BNPL loans don't behave like traditional credit by breaking a purchase into interest-free installments.

- Experts fear trouble for Gen Z, the main BNPL users, as FICO incorporates BNPL data.

- FICO's move follows Affirm's decision to report new loans to Experian and TransUnion.

- BNPL's popularity is rising, with total US transactions expected to reach $108 billion by 2025.

- Research shows an increase in BNPL late payments, with users relying on it for essentials like groceries.

- Gen Z and millennials are the main users of BNPL, with Gen Z showing a higher likelihood of having multiple BNPL loans concurrently.

- BNPL's lack of impact on credit scores was previously attractive, but its inclusion may change this.

- Young consumers, like Gen Z, are possibly using BNPL to manage rising living costs and avoid credit card debt.

- BNPL can improve credit scores with good repayment behavior, but multiple unsecured credit lines may lead to a negative score.

- BNPL users are more likely to face financial constraints, especially if they pay late.

- Increased regulation in the payments space could expose consumer vulnerabilities and impact credit scores.

- Researchers plan to monitor Gen Z spending habits to assess the risks posed by BNPL.

- Gen Z's tech savviness and openness to new payment technologies have contributed to their high BNPL usage.

Insider | 24 Jun, 2025

FICO to Launch Credit Scores That Incorporate BNPL Data

- FICO will launch credit scores incorporating buy now, pay later (BNPL) data in the fall.

- The new FICO Score 10 BNPL and FICO Score 10 T BNPL will be introduced without additional fees initially.

- These scores aim to provide lenders with insights into consumers' payment behaviors and promote financial inclusion.

- The addition of BNPL data is based on a study with BNPL company Affirm, showing varied impacts on FICO score predictiveness.

- Affirm plans to provide information on all payment plans to Experian and TransUnion, not immediately impacting traditional credit scores.

- BNPL plans are highlighted as a significant support for individuals facing financial struggles, as per a PYMNTS Intelligence eBook.

Pymnts | 23 Jun, 2025

Got kids? You're the sort of customer Uber Eats and DoorDash really want

- A report by TransUnion found that households with kids are considered 'power users' of apps like Uber and DoorDash, using the services more frequently and spending more on them than those without children.

- 61% of respondents with children order food for delivery 'once or multiple times a week,' compared to about 40% of respondents without kids.

- Households with children tend to spend more on gig services, with 23% spending at least $500 a month, compared to only 5% of childless users.

- Uber and other gig apps are looking to cater more to families by offering features like teen accounts for ordering food or rides with parental oversight and targeting promotions specifically towards families to increase their usage and spending on the platform.

Insider | 19 May, 2025

What’s your India plan?

- Tesla is working on entering the Indian market due to its potential among the big middle class.

- Philip Morris International notes sustained volume gains in markets like India where smoke-free products are not permitted.

- Otis Worldwide Corporation experiences robust order growth primarily driven by India, securing a landmark contract with the Prestige group.

- TransUnion is selling well in India and expects an increase in consumer lending activity with the support of RBI's posture.

HinduBusinessLine | 26 Apr, 2025

Affirm to Report All Pay-Over-Time Loans to TransUnion

- Affirm will begin reporting all pay-over-time loans to TransUnion, starting from May 1.

- The expanded credit reporting will include Affirm's Pay in 4 and longer-term monthly installments.

- The reported transactions will not be visible to lenders or factored into traditional credit scores.

- However, the information may influence future credit scores as new credit scoring models are developed.

Pymnts | 22 Apr, 2025

TransUnion caps massive data migration project with new analytics and security services

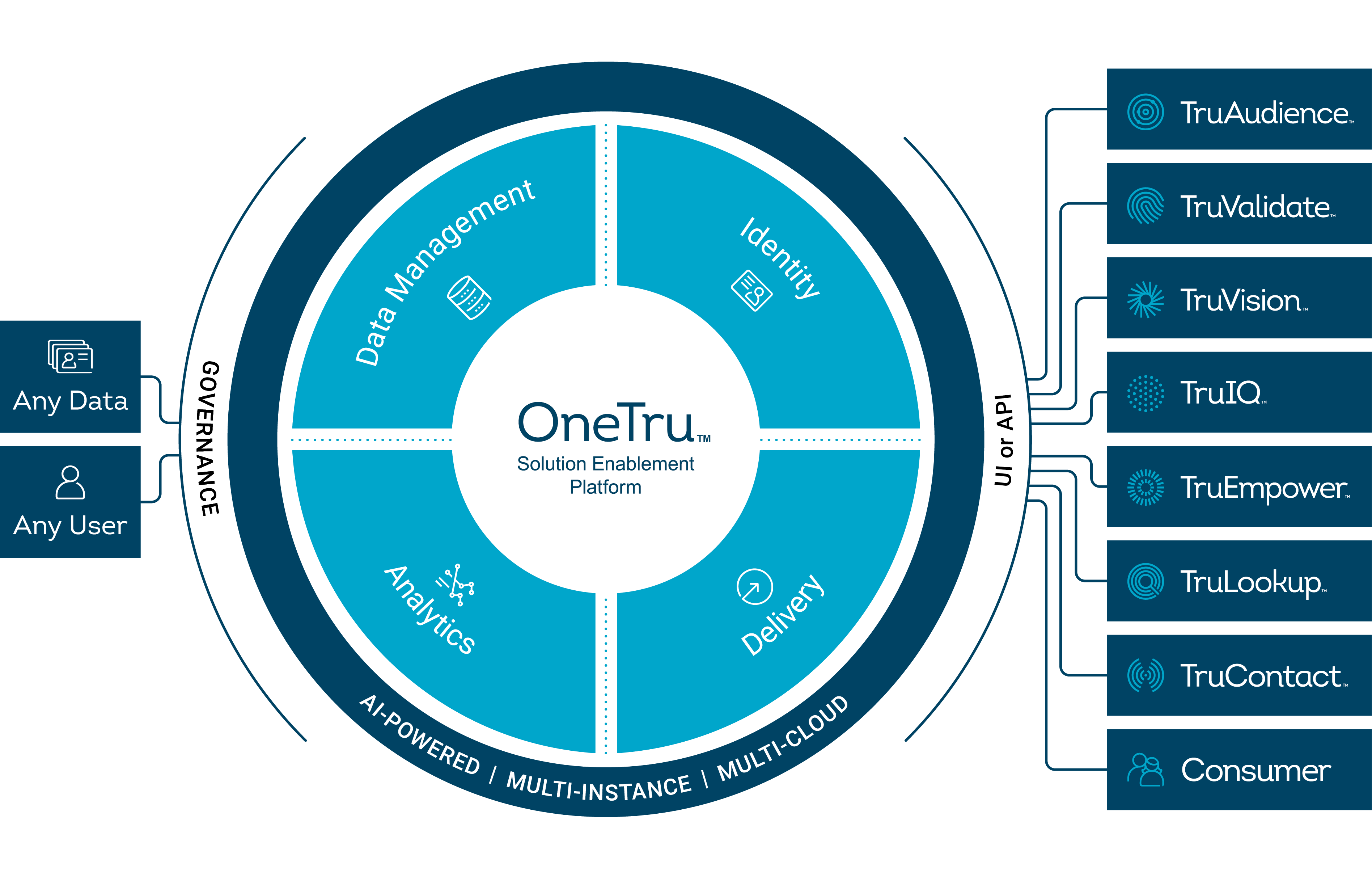

- Credit reporting company TransUnion caps its massive data migration project with the completion of its OneTru platform, which has provided multiple benefits internally and for its business customers.

- TransUnion's alternative lending bureau uses OneTru to introduce new credit risk products, while marketers utilize the TruAudience line of products for identity-driven marketing.

- TransUnion's TruValidate fraud prevention service has improved fraud capture rates and reduced false positives, resulting in increased fraud capture rates for financial institutions.

- TransUnion has seen over a 50% productivity boost from migrating legacy products to run on top of the OneTru platform.

Siliconangle | 10 Apr, 2025

TransUnion Spikes on Assessment

- TransUnion completes FedRAMP Ready assessment for TruValidate solutions for government.

- TruValidate's anti-fraud capabilities are critical for Federal Risk and Authorization Management Program (FedRAMP) compliance.

- TruValidate Identity Verification reduces time and effort for legitimate constituents to prove their identity and helps detect fraudulent activities.

- TransUnion's stock price (TRU) increased to $88.38 in response to the news.

Baystreet | 26 Mar, 2025

From shadow IT to singular truth: Axonius reshapes cybersecurity visibility

- Fragmentation in cybersecurity, caused by shadow IT and disconnected tools, leads to a lack of visibility into organizational security.

- Axonius addresses this challenge by offering a platform that provides a unified asset data model for proactive security measures.

- Creating a single source of truth in cybersecurity is crucial for driving meaningful actions and consolidating data from various tools.

- Transitioning from reactive to proactive security requires understanding threats, prioritization, and contextual actionability.

- The success of cybersecurity programs now relies not only on technical skills but also on communication, trust-building, and leadership.

- Security professionals, like Kara Keene from TransUnion, emphasize the importance of empathy and collaboration in transforming security culture.

- CISOs are evolving into behavior-change agents, focusing on internal credibility and human-driven risks rather than technical enforcement.

- Data governance is essential in addressing compliance gaps and scaling risk oversight, particularly as AI adoption accelerates.

- Prioritizing known vulnerabilities over hypothetical threats and simplifying risk management processes are key in governance strategies.

- National risk governance requires integrated technologies and education to enhance situational awareness and address modern threats.

Siliconangle | 26 Mar, 2025

10 Essential Tips for Streamlining Your Property Management Process

- Property management requires efficient operational systems to reduce workload and increase tenant satisfaction.

- Software tools like Buildium and Rentec Direct automate rent collection, maintenance tracking, and tenant communication.

- Automated operations through software save time and reduce paperwork errors in managing tenant details and records.

- Online rent payment options like PayPal and Venmo benefit property managers and tenants by ensuring timely payments.

- Implementing a standardized screening process using services like TransUnion SmartMove helps in selecting high-quality tenants.

- Utilizing paperless systems like DocuSign and Google Drive improves operational efficiency and ensures safe document storage.

- Proactive property maintenance scheduling aids in early problem detection and preserves property quality.

- Open communication channels between property managers and tenants are essential for smooth operations.

- Outsourcing specific tasks in property management can help in focusing on strategic planning and business growth.

- Efficient maintenance request management through digital platforms enhances property upkeep and tenant satisfaction.

- Adhering to legal regulations and automating compliance measures minimize legal risks and maintain efficient property operations.

TechBullion | 12 Mar, 2025

Powered by

TransUnion Offices

Compare TransUnion with

Angel One

3.8

Broadridge Financial Solutions

3.9

AGS Transact Technologies

2.9

PayPal

3.8

MasterCard

3.9

Hitachi Payment Services

3.7

Rupeek

3.7

Mswipe Technologies

3.2

Truhome Finance

3.7

BankBazaar

3.3

Unimoni

3.9

PayU Payments

3.5

Revolut

2.6

Visa

3.5

Saxo Bank

3.2

Western Union

3.3

Worldline Group

3.9

Verifone

3.2

Euronet Worldwide

3.8

Crif Solutions

3.4

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Companies Similar to TransUnion

Broadridge Financial Solutions

Internet, Manufacturing, Electronics, FinTech

3.9

• 1.3k reviews

AGS Transact Technologies

Financial Services, FinTech

2.9

• 1.2k reviews

PayPal

Financial Services, Internet, FinTech

3.8

• 1k reviews

MasterCard

Financial Services, Internet, FinTech

3.9

• 814 reviews

Hitachi Payment Services

Financial Services, Internet, FinTech

3.7

• 808 reviews

Rupeek

FinTech

3.7

• 800 reviews

Mswipe Technologies

Financial Services, Internet, FinTech

3.2

• 696 reviews

Truhome Finance

FinTech

3.7

• 661 reviews

TransUnion FAQs

When was TransUnion founded?

TransUnion was founded in 1968. The company has been operating for 57 years primarily in the FinTech sector.

Where is the TransUnion headquarters located?

TransUnion is headquartered in Chicago, Illinois.

How many employees does TransUnion have in India?

TransUnion currently has more than 3,000+ employees in India. Engineering - Software & QA department appears to have the highest employee count in TransUnion based on the number of reviews submitted on AmbitionBox.

Does TransUnion have good work-life balance?

TransUnion has a work-life balance rating of 4.0 out of 5 based on 500+ employee reviews on AmbitionBox. 76% employees rated TransUnion 4 or above on work-life balance. This rating reflects the company's efforts to help employees maintain a healthy balance between their personal and professional lives. We encourage you to read TransUnion work-life balance reviews for more details.

Is TransUnion good for career growth?

Career growth at TransUnion is rated as moderate, with a promotions and appraisal rating of 3.2. 24% employees rated TransUnion 3 or below, while 76% employees rated it 4 or above on promotions / appraisal. This rating suggests that while some employees view growth opportunities favorably, there is scope for improvement based on employee feedback. We recommend reading TransUnion promotions / appraisals reviews for more detailed insights.

What are the pros and cons of working in TransUnion?

Working at TransUnion comes with several advantages and disadvantages. It is highly rated for company culture, salary & benefits and work life balance. However, it is poorly rated for promotions / appraisal, skill development and work satisfaction, based on 500+ employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Trusted by over 1.5 Crore job seekers to find their right fit company

80 Lakh+

Reviews

10L+

Interviews

4 Crore+

Salaries

1.5 Cr+

Users

Contribute to help millions

AmbitionBox Awards

Get AmbitionBox app