Add office photos

Employer?

Claim Account for FREE

Indian Bank![]()

3.4

based on 414 Reviews

Video summary

Company Overview

Associated Companies

Company Locations

Working at Indian Bank

Company Summary

Overall Rating

3.4/5

based on 414 reviews

11% below

industry average

Highly rated for

Job security

Critically rated for

Work-life balance, Work satisfaction, Company culture

Work Policy

Work from office

84% employees reported

Alternate Saturday off

45% employees reported

Strict timing

69% employees reported

No travel

36% employees reported

View detailed work policy

Top Employees Benefits

Job/Soft skill training

27 employees reported

Health insurance

21 employees reported

Professional degree assistance

8 employees reported

Cafeteria

7 employees reported

View all benefits

About Indian Bank

Founded in1907 (118 yrs old)

India Employee Count10k-50k

Global Employee Count10k-50k

India HeadquartersChennai, India

Websiteindianbank.in

Primary Industry

Other Industries

Are you managing Indian Bank's employer brand? To edit company information,

claim this page for free

View in video summary

Established on 15th August 1907, as part of the Swadeshi movement, Indian Bank has come a long way and today, stands as one of India’s premier public sector banks. Headquartered at Chennai, we are a strong and diverse 20,000 workforce, always committed to bring the best of conventional and contemporary banking to you. With a vast national footprint and robust international connections via correspondent banks in 72 countries besides branch presence in Singapore and Sri Lanka, we serve customers across the spectrum of retail, agricultural, corporate, institutional and SME domain. We have diversified banking activities with 2 subsidiary companies - Indbank Merchant Banking Services Ltd and IndBank Housing Ltd.

Deposits, Loans, Cards, Wallets, Apps, Insurance, Mutual Funds, Forex, Remittance and Wealth Management Services make up our product portfolio. We also take pride in consistently engaging with the various social and empowering pillars of the society through our Corporate Social Responsibility initiatives.

Mission: The Bank's mission is "To be a Common Man's Bank" - to provide all financial products and Services:

* Under one roof

* At affordable cost

* In a fair and transparent manner to all our customers.

Vision: To be a Competitive and Strong Bank with commitment to excellence and focus on adding value to customers, share holders and employees with adherence to best practices and core institutional values shared throughout the organisation

Report error

Managing your company's employer brand?

Claim this Company Page for FREE

Indian Bank Ratings

based on 414 reviews

Overall Rating

3.4/5

How AmbitionBox ratings work?

5

174

4

72

3

72

2

36

1

60

Category Ratings

4.0

Job security

3.4

Salary

3.1

Skill development

3.1

Promotions

2.9

Company culture

2.9

Work satisfaction

2.8

Work-life balance

Indian Bank is rated 3.4 out of 5 stars on AmbitionBox, based on 414 company reviews.This rating reflects an average employee experience, indicating moderate satisfaction with the company’s work culture, benefits, and career growth opportunities. AmbitionBox gathers authentic employee reviews and ratings, making it a trusted platform for job seekers and employees in India.

Read more

Gender Based Ratings at Indian Bank

based on 374 reviews

3.3

Rated by 72 Women

Rated 3.8 for Job security and 3.4 for Salary

3.4

Rated by 302 Men

Rated 4.1 for Job security and 3.4 for Salary

Work Policy at Indian Bank

based on 53 reviews in last 6 months

Work from office

84%

Hybrid

9%

Permanent work from home

7%

Indian Bank Reviews

Top mentions in Indian Bank Reviews

+ 5 more

Compare Indian Bank with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 3.4/5 based on 414 reviews | 3.5/5 based on 12.1k reviews | 3.7/5 based on 19.3k reviews | 4.2/5 based on 12.5k reviews |

Highly Rated for | Job security |  No highly rated category |  No highly rated category | Skill development Job security Work-life balance |

Critically Rated for | Work-life balance Company culture Work satisfaction | Promotions Company culture Work satisfaction | Promotions |  No critically rated category |

Primary Work Policy | Work from office 84% employees reported | Work from office 89% employees reported | Work from office 81% employees reported | Work from office 86% employees reported |

Rating by Women Employees | 3.3 Average rated by 72 women | 3.2 Average rated by 2.2k women | 3.5 Good rated by 4.3k women | 4.2 Good rated by 1.4k women |

Rating by Men Employees | 3.4 Average rated by 302 men | 3.5 Good rated by 9.4k men | 3.8 Good rated by 14.4k men | 4.2 Good rated by 10.6k men |

Job security | 4.0 Good | 3.5 Good | 3.7 Good | 4.1 Good |

View more

Indian Bank Salaries

Indian Bank salaries have received with an average score of 3.4 out of 5 by 414 employees.

Chief Manager

(84 salaries)

Unlock

₹20 L/yr - ₹34.3 L/yr

Branch Manager

(80 salaries)

Unlock

₹10.8 L/yr - ₹18.8 L/yr

Credit Manager

(33 salaries)

Unlock

₹9.4 L/yr - ₹16.9 L/yr

Assistant Branch Manager

(24 salaries)

Unlock

₹8.6 L/yr - ₹13 L/yr

Clerk

(23 salaries)

Unlock

₹2.4 L/yr - ₹7.3 L/yr

Senior Manager Credit

(20 salaries)

Unlock

₹14.2 L/yr - ₹22 L/yr

Branch Head

(18 salaries)

Unlock

₹13.7 L/yr - ₹25 L/yr

Sub Staff

(16 salaries)

Unlock

₹1 L/yr - ₹2.5 L/yr

Credit Analyst

(12 salaries)

Unlock

₹11.1 L/yr - ₹16.5 L/yr

Assistant General Manager

(11 salaries)

Unlock

₹26.5 L/yr - ₹43.4 L/yr

Indian Bank Interview Questions

A Senior Manager was asked 9mo agoQ. What is your USP for this field?

A Senior Manager was asked Q. Is bank nationalization necessary for India?

A Senior Manager was asked Q. How many types of banks are there in India?

An Associate Vice President Digital Marketing was asked 3mo agoQ. What is the difference between SEO and SEM?

An Associate Vice President Digital Marketing was asked 3mo agoQ. What is SEO?

Indian Bank News

View all

Indian Bank Cuts Lending Rate By 5 Bps

- Indian Bank has reduced its Marginal Cost of Funds Based Lending Rate for one year maturity by 5 basis points to 9%.

- The new rate will be effective from July 3, benefiting borrowers with lower interest rates on various loans.

- In addition to the rate cut, Indian Bank has waived minimum balance charges across all Savings Bank accounts, effective from July 7.

- This initiative aims to promote financial inclusion and make banking more accessible to all sections of society.

Bloomberg Quint | 2 Jul, 2025

Tamilnad Mercantile Bank appoints K Ramachandran as Additional Director and Part-Time Chairman of the Bank

- K Ramachandran has been appointed as an Additional Director and Part-Time Chairman of Tamilnad Mercantile Bank.

- His appointment as an Additional Director is for three years starting June 12, contingent on shareholders' approval.

- His part-time chairman appointment, subject to RBI approval, will last for three years from the approval date.

- RBI has granted a six-month extension to YES Bank chief Prashant Kumar.

- Ramachandran, a banker with over three decades of experience, started as an officer and progressed to become a Whole-Time Director.

- He previously served as Executive Director at Allahabad Bank and Indian Bank and was instrumental in the successful merger of Allahabad Bank with Indian Bank.

- During his tenure as Executive Director, he led various strategic initiatives such as Total Branch Automation and Core Banking implementation.

- The news was published on June 13, 2025.

HinduBusinessLine | 13 Jun, 2025

Empowering grassroots: Indian Bank’s SHG lending as a catalyst for inclusive growth

- Indian Bank's SHG lending program is empowering women like P Uma and Hemalatha to start successful businesses and improve their livelihoods.

- The bank's SHG Credit Programme has helped thousands of families increase their incomes, meet essential needs, and move out of economic vulnerability.

- Indian Bank has significantly grown its SHG loan book and aims to expand its reach to underserved states in India.

- The bank targets a substantial SHG credit amount by 2027 through rural penetration and alignment with government initiatives.

- Members of SHGs are being encouraged to open Jan Dhan accounts and access personalized financial tools for individual financial empowerment.

- Indian Bank's Microsate branches provide dedicated services to SHG clients and foster an inclusive and safe environment for women entrepreneurs.

- The bank goes beyond credit by offering CSR initiatives, insurance schemes, zero-balance accounts, and RuPay cards to SHG members.

- Indian Bank partners with NRLM and NULM to promote and build the capacity of SHGs across India, facilitating rural and urban livelihood missions.

- Some SHGs have transformed into registered enterprises, leveraging online platforms and even exporting products globally, with support from Indian Bank.

- The bank sees SHG lending as a means to drive entrepreneurship, empower women, and contribute to rural development in alignment with national priorities.

HinduBusinessLine | 11 Jun, 2025

Stock Market Today: All You Need To Know Going Into Trade On June 10

- India's benchmark equity indices closed higher for the fourth straight session on Monday fueled by positive global cues and strong US jobs data.

- NSE Nifty 50 closed 0.4% higher at 25,103.2, while BSE Sensex ended 0.31% up at 82,445.21.

- Foreign portfolio investors remained net buyers of Indian equities, while domestic institutional investors continued as net buyers for the 15th consecutive session.

- Key stocks to watch include Capri Global Capital, Tata Power, Wipro, Force Motors, HCLTech, Mahindra and Mahindra Finance, among others.

- Block deals involved Wipro, Suzlon Energy, and Shankara Building Products with significant transactions reported.

- Insider trades included actions in companies like Deccan Gold Mines, Usha Martin, Geojit Financial Services, Suprajit Engineering, and MTAR Technologies.

- Trading tweaks such as ex-dividend and ex-stock split were observed in companies like Indian Bank, Tata Investment Corp, Asian Paints, and Vesuvius India.

- In the F&O segment, Nifty June Futures were up, with notable open interest positions for June 12 expiry highlighted.

- Currency and bond updates revealed the rupee closing flat against the US Dollar and the 10-year government bond yield ending higher.

- Overall, the stock market showed positive momentum, driven by global factors and notable activities in various stocks and trading segments.

Bloomberg Quint | 10 Jun, 2025

Banks Lower Interest Rates After RBI Repo Rate Cut: Who Will Benefit From This?

- Several banks have started lowering their lending rates after the RBI's repo rate reduction to stimulate credit demand and economic activity.

- Existing borrowers with floating-rate loans are expected to benefit from the decrease in home loan and personal loan EMIs due to the rate revision.

- Bank of Baroda, Punjab National Bank, Bank of India, Indian Bank, and UCO Bank are among the early responders by lowering their Repo-Linked Lending Rates (RLLRs).

- Cheaper loans resulting from the rate cuts could potentially benefit sectors like real estate and have positive effects on construction, manufacturing, and consumer goods industries.

Bloomberg Quint | 9 Jun, 2025

Banks’ cut repo-linked lending rates by 50 bps, making home and vehicle loans cheaper

- Public sector banks have cut their repo-linked lending rates (RLLRs) by 50 bps following a 50 bps reduction in the repo rate by the monetary policy committee on June 6th.

- Along with the repo rate cut, the central bank also reduced the cash reserve ratio (CRR) by 100 bps from 4% to 3%, aiming to improve liquidity and facilitate quicker transmission of rate cuts to lending and deposit rates.

- Banks like PNB, BoI, UCO Bank, Indian Bank, BoB, and Karur Vysya Bank have all adjusted their RLLRs and MCLR rates in response to the recent policy changes, leading to cheaper home and vehicle loans.

- The rate cuts are expected to impact banks' net interest margins (NIMs) in the short term, with a gradual improvement predicted in the following quarters due to CRR reduction and adjustments in deposit rates.

HinduBusinessLine | 8 Jun, 2025

Which Stocks To Buy Today? Gaurav Sharma Recommends Glenmark, Oberoi Realty

- Gaurav Sharma, an associate VP at Globe Capital, recommends buying Glenmark Pharmaceuticals Ltd., Oberoi Realty Ltd., and Indian Bank Ltd. stocks.

- For Glenmark Pharmaceuticals, Sharma suggests buying at Rs 1,512 with a stop-loss at Rs 1,470 and a target price of Rs 1,600.

- Oberoi Realty Ltd. is advised as a 'buy' at Rs 1,794 with a stop-loss at Rs 1,720 and a target price of Rs 1,945.

- Indian Bank is recommended for purchase at Rs 632 with a stop-loss at Rs 618 and a target price of Rs 665.

Bloomberg Quint | 4 Jun, 2025

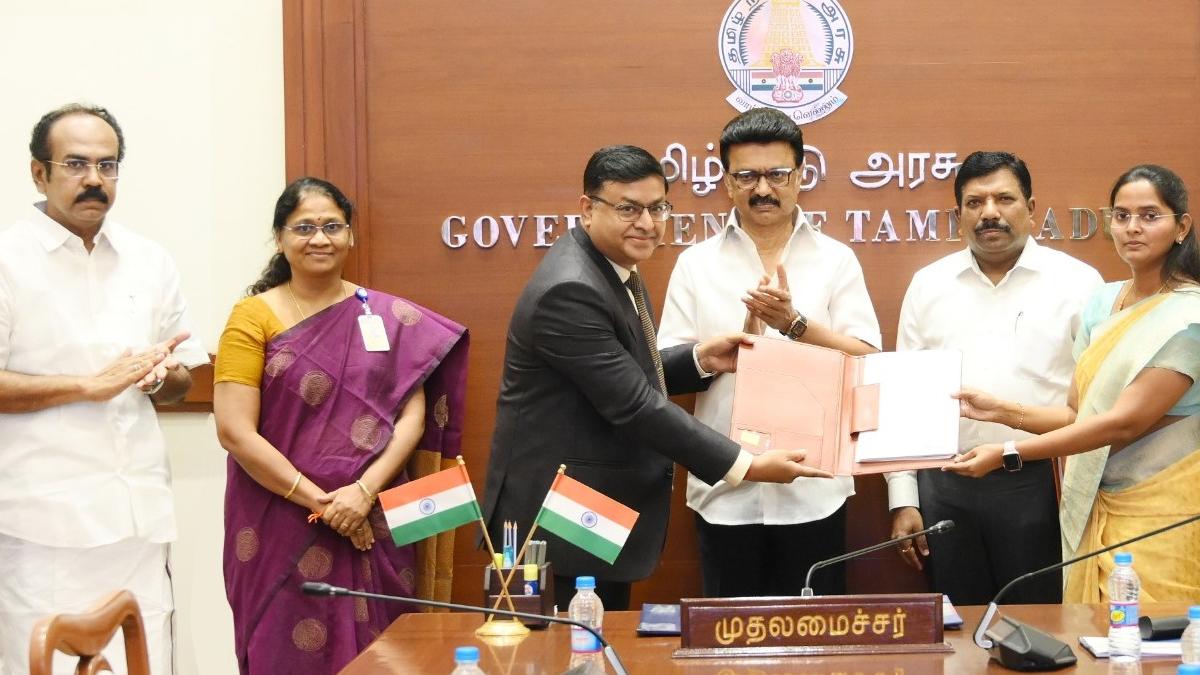

TN Govt inks pact with with 7 banks for employee insurance and loan benefits

- Tamil Nadu government has signed a Memoranda of Association with 7 banks for employee insurance and loan benefits.

- The banks involved are Indian Bank, Indian Overseas Bank, State Bank of India, Canara Bank, Axis Bank, Bank of Baroda, and Union Bank of India.

- Key provisions of the agreement include personal accident insurance cover, marriage assistance, higher education assistance, and term life insurance cover for government employees.

- The agreement also entails interest concessions on personal loans, housing loans, and education loans for government employees from the mentioned banks.

HinduBusinessLine | 19 May, 2025

Banks Start Lowering MCLR A Month After RBI's Repo Rate Cut

- Some banks have started cutting their marginal cost of fund-based lending rates (MCLR) a month after RBI's repo rate cut of 25 basis points to 6%.

- Canara Bank has reduced its MCLR by 10 basis points, while other banks like Tamilnad Mercantile Bank, Punjab National Bank, Indian Bank made similar changes in their MCLR rates.

- While the repo rate cut by RBI is yet to fully reflect in deposit rates, MCLR cuts usually take a few months to be implemented, affecting borrowing costs for customers.

- RBI's recent change to a neutral stance from accommodative aims at stimulating the economy through softer interest rates, with the transmission of rates expected to happen gradually in the latter part of the financial year.

Bloomberg Quint | 12 May, 2025

Public sector banks assure customers of normal functioning of all alternate banking channels

- Public sector banks in India have assured customers that all alternate banking channels are functioning normally amidst escalating tensions between India and Pakistan.

- State-owned banks like State Bank of India, PNB, Bank of Baroda, Canara Bank, and Union Bank of India have confirmed the normal operations of ATMs, digital services, and other banking channels.

- Union Bank of India highlighted its preparedness for cyber threats with advanced security measures and continuous monitoring of digital assets.

- Indian Bank also emphasized the availability of their ATMs 24X7 but warned customers to stay vigilant against phishing attempts and downloading files from unknown sources.

HinduBusinessLine | 9 May, 2025

Powered by

Indian Bank Subsidiaries

Pallavan Grama Bank

3.5

• 4 reviews

Report error

Compare Indian Bank with

IDFC FIRST Bank

3.9

Bandhan Bank

3.7

Yes Bank

3.7

Jana Small Finance Bank

3.8

Equitas Small Finance Bank

4.4

Ujjivan Small Finance Bank

4.0

Standard Chartered

3.6

State Bank of India

3.8

Deutsche Bank

3.9

Bank of America

4.2

NatWest Group

4.1

Barclays

3.8

IDBI Bank

3.5

Federal Bank

3.8

Union Bank of India

3.8

Central Bank of India

3.9

HSBC Global Banking and Markets

4.0

Indian Overseas Bank

3.3

Bank of Maharashtra

3.3

NatWest Markets

3.8

Edit your company information by claiming this page

Contribute & help others!

You can choose to be anonymous

Companies Similar to Indian Bank

Kotak Mahindra Bank

Financial Services, Banking

3.7

• 19.3k reviews

AU Small Finance Bank

Financial Services, Banking

4.2

• 12.5k reviews

IndusInd Bank

Financial Services, Banking

3.5

• 12.1k reviews

Bandhan Bank

Financial Services, Banking

3.7

• 8.8k reviews

Yes Bank

Banking / Insurance / Accounting, Financial Services, Banking

3.7

• 8.7k reviews

Jana Small Finance Bank

Banking

3.8

• 6.7k reviews

Equitas Small Finance Bank

Financial Services, Banking

4.4

• 6.4k reviews

Ujjivan Small Finance Bank

Financial Services, Banking

4.0

• 6k reviews

Standard Chartered

Biotech & Life sciences, BPO/KPO, Financial Services, Non-Profit, Analytics & KPO, Banking, IT Services & Consulting

3.6

• 5.1k reviews

State Bank of India

Financial Services, Banking

3.8

• 4.3k reviews

Deutsche Bank

Financial Services, Banking

3.9

• 3.9k reviews

Bank of America

Financial Services, Banking

4.2

• 3.5k reviews

Indian Bank FAQs

When was Indian Bank founded?

Indian Bank was founded in 1907. The company has been operating for 118 years primarily in the Banking sector.

Where is the Indian Bank headquarters located?

Indian Bank is headquartered in Chennai. It operates in 2 cities such as Chennai, Mumbai. To explore all the office locations, visit Indian Bank locations.

How many employees does Indian Bank have in India?

Indian Bank currently has more than 41,000+ employees in India. BFSI, Investments & Trading department appears to have the highest employee count in Indian Bank based on the number of reviews submitted on AmbitionBox.

Does Indian Bank have good work-life balance?

Indian Bank has a work-life balance rating of 2.8 out of 5 based on 400+ employee reviews on AmbitionBox. 41% employees rated Indian Bank 3 or below for work-life balance. This rating reflects a negative sentiment among employees for work-life balance. We encourage you to read Indian Bank work-life balance reviews for more details.

Is Indian Bank good for career growth?

Career growth at Indian Bank is rated as moderate, with a promotions and appraisal rating of 3.1. 41% employees rated Indian Bank 3 or below, while 59% employees rated it 4 or above on promotions / appraisal. This rating suggests that while some employees view growth opportunities favorably, there is scope for improvement based on employee feedback. We recommend reading Indian Bank promotions / appraisals reviews for more detailed insights.

What are the pros and cons of working in Indian Bank?

Working at Indian Bank comes with several advantages and disadvantages. It is highly rated for job security. However, it is poorly rated for work life balance, work satisfaction and company culture, based on 400+ employee reviews on AmbitionBox.

Stay ahead in your career. Get AmbitionBox app

Trusted by over 1.5 Crore job seekers to find their right fit company

80 Lakh+

Reviews

10L+

Interviews

4 Crore+

Salaries

1.5 Cr+

Users

Contribute to help millions

AmbitionBox Awards

Get AmbitionBox app