CSB Bank![]()

Working at CSB Bank

Company Summary

Overall Rating

16% below

Critically rated for

Promotions, Work satisfaction, Company culture

Work Policy

Top Employees Benefits

About CSB Bank

We are one of the oldest private sector banks in India with a history of over 98 years, and a strong base in Kerala along with significant presence in Tamil Nadu, Karnataka, and Maharashtra. We offer a wide range of products and services to our overall customer base of 1.3 million as on March 31, 2019, with particular focus on SME, retail, and NRI customers. We deliver our products and services through multiple channels, including 414 branches (excluding three service branches and two asset recovery branches) and 277 ATMs spread across 16 states and four union territories as on March 31, 2019, and various alternate channels such as micro ATMs, debit cards, internet banking, mobile banking, point of sale services, and UPI. We believe with our focus on quality of service and nurturing long term relationship with our customers, we have developed a well-recognized and trusted brand in south India, particularly in the states of Kerala and Tamil Nadu.

CSB Bank Ratings

Overall Rating

Category Ratings

Salary

Work-life balance

Job security

Skill development

Company culture

Work satisfaction

Promotions

Work Policy at CSB Bank

CSB Bank Reviews

Top mentions in CSB Bank Reviews

Compare CSB Bank with Similar Companies

|  Change Company |  Change Company |  Change Company | |

|---|---|---|---|---|

Overall Rating | 3.2/5 based on 1.4k reviews | 3.5/5 based on 12.1k reviews | 3.9/5 based on 11.9k reviews  | 4.2/5 based on 12.5k reviews |

Highly Rated for |  No highly rated category |  No highly rated category | Salary Skill development | Skill development Job security Work-life balance |

Critically Rated for | Promotions Company culture Work satisfaction | Promotions Company culture Work satisfaction |  No critically rated category |  No critically rated category |

Primary Work Policy | Work from office 91% employees reported | Work from office 89% employees reported | Work from office 83% employees reported | Work from office 86% employees reported |

Rating by Women Employees | 3.2 Average rated by 319 women | 3.2 Average rated by 2.2k women | 3.7 Good rated by 1.8k women | 4.2 Good rated by 1.4k women |

Rating by Men Employees | 3.2 Average rated by 1.1k men | 3.5 Good rated by 9.4k men | 4.0 Good rated by 9.5k men | 4.2 Good rated by 10.6k men |

Job security | 3.0 Average | 3.5 Good | 3.7 Good | 4.1 Good |

CSB Bank Salaries

Branch Manager

Brach Operation Manager

Customer Relationship Officer

Business Development Executive

Relationship Manager

Gold Loan Officer

Deputy Manager

Senior Officer

Relationship Executive

Assistant Vice President

CSB Bank Interview Questions

CSB Bank Jobs

CSB Bank News

Why these Adani, Bajaj group stocks will seek market attention

- Bajaj Consumer Care announced the appointment of Naveen Pandey as managing director to replace Jaideep Nandi, whose term ends on June 30.

- Aakash Gupta has been appointed as Head-Finance, effective from July 1.

- Bajel Projects secured a large order from the energy and power transmission sector for the establishment of substations.

- CSB Bank has extended Pralay Mondal's term as managing director and CEO for three years, starting from September 15, 2025.

- Adani Group plans to invest $15-20 billion annually across its businesses for the next five years for growth and expansion.

- Adani aims to reach 100 gigawatts of electricity generation capacity by 2030 and expand into various sectors using strong earnings.

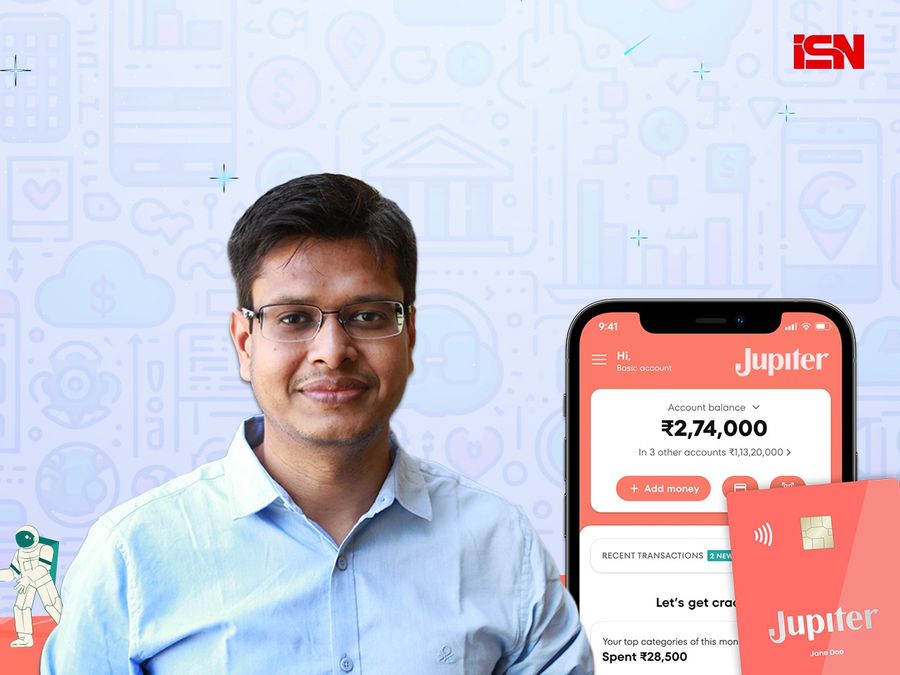

Jupiter partners with CSB Bank to launch its most rewarding RuPay credit card

- Indian fintech firm Jupiter has partnered with CSB Bank to launch the Edge+ CSB Bank RuPay Credit Card, described as their most rewarding and no annual fee card.

- The card integrates UPI and traditional card transactions, providing over Rs 50,000 in annual rewards and financial insights.

- Jupiter's Founder & CEO, Jitendra Gupta, stated that the card represents the company's focus on simple, powerful, and rewarding money experiences.

- The Edge+ card is exclusively available on Jupiter's app and targets digital native and rewards-savvy consumers.

- Rohit K Pandey, President of Jupiter Money, highlighted the innovative rewards program benefits on platforms like Amazon, Myntra, Nykaa, MakeMyTrip, and others.

- Cardholders can enjoy 10% cashback on Amazon, Myntra, and Nykaa, 5% on MakeMyTrip and Yatra, and 1% on other eligible spends, redeemable in various ways.

- Jupiter, founded in 2019, provides financial services such as debit cards, SIPs, mutual funds, savings options, expense management, and UPI payments.

IDBI Bank Acquisition Hopes Prompt Emirates NBD To Go Down The WOS Route — Profit Exclusive

- Emirates NBD is competing to acquire IDBI Bank and has chosen to establish a wholly-owned subsidiary in India for its offer to be more appealing.

- This subsidiary model enables foreign lenders to add branches effortlessly and acquire local franchises, as seen during DBS Bank India's takeover of Lakshmi Vilas Bank in 2020.

- Emirates NBD's use of the wholly-owned subsidiary may give them an advantage in the acquisition race against Fairfax Capital, which already has ownership in CSB Bank.

- Concerns regarding union opposition and regulatory approvals are being monitored by bidders as they anticipate the IDBI Bank acquisition process to conclude by the end of the current financial year or early next year.

CSB Bank Q4 Review: High Fee Lines Offset NIM Pressures; Dolat Capital Maintains 'Buy', Hikes Target Price

- CSB Bank's net interest margin (NIM) is expected to be in the range of 3.75-4.1% in FY26.

- CSB Bank stands out for its healthy net interest margin, improving fee lines, and strong asset quality.

- A high share of fixed-rate loans will favor NIM in a declining interest-rate environment.

- Despite elevated operating expenses, CSB Bank's return on assets (RoAs) remains healthy at ~1.5%.

CSB Bank Q4 profit rises 26% to ₹190 crore

- CSB Bank's Q4 profit rose 26% to ₹190 crore.

- The net interest income (NII) was down 4% YoY to ₹371 crore.

- Overall advances of the bank rose 30% YoY to ₹31,842 crore, while deposits were up 24% YoY at ₹36,861 crore.

- Gross non-performing asset ratio (GNPA) stood at 1.57% in Q4FY25.

Stocks To Watch Today: RIL, HCLTech, Force Motors, L&T Finance, Tejas Networks

- Stocks to watch today include RIL, HCLTech, Force Motors, L&T Finance, Tejas Networks, RBL Bank, Tata Technologies, and Poonawala Fincorp.

- Key updates include HCL Technologies acquiring KHY E4lectronics, GAIL signing an MoU with Container Corp., and Axis Bank announcing a change in management.

- Other highlights involve Aditya Birla Sun Life planning to raise funds, Apollo Tyres closing operations in the Netherlands, and Mahindra & Mahindra acquiring SML Isuzu.

- Additionally, Aurobindo Pharma's positive opinion on Dazublys®, Zydus Lifesciences' inspection by USFDA, and Biocon's biosimilar approval by EMA were noted.

- Companies like Harsha Engineers, Alembic Pharma, and Eicher Motors introduced new facilities and products, while Railtel Corp received an order from The Institute of Road Transport.

- Post-market earnings highlighted performance by RBL Bank, Reliance Jio, Reliance Industries, Tata Technologies, DCB Bank, Poonawala Fincorp, Rossari Biotech, Oracle Financial Services, and others.

- Notable financial results included Force Motors' revenue and profit growth, LT Finance's increase in revenue and net profit, and Tejas Networks' decline in EBITDA and net profit.

- Further details on companies like Zensar Tech, Lloyds Metals and Energy, IDFC First Bank, MRPL, India Cements, Ugro Capital, SBFC Finance, IGL, and others were also provided.

- Earnings announcements to watch included UltraTech Cement, Aditya Birla Sun Life AMC, Castrol India, CSB Bank, Firstsource Solutions, Go Digit General Insurance, and more.

- The article covers various company updates, financial performances, and upcoming earnings reports to watch in the current market scenario.

- For more detailed information, readers can refer to the original article on NDTV Profit.

Stocks In News At Noon: BEL, Tata Motors, CSB Bank Among Others

- Bharat Electronics Ltd. saw its share price decline by over 5% on Wednesday after the company missed its fiscal 2025 order inflow guidance. BEL secured orders worth Rs 18,715 crore, falling short of its projected Rs 25,000 crore, achieving only 74.86% of the target. Despite this, the company reported a 16% rise in revenue, reaching Rs 23,000 crore compared to Rs 19,820 crore the previous year.

- Tata Motors shares fell on Wednesday after the company reported flat domestic sales for March 2025. Investor sentiment was further weighed down by confirmation that the United States President Donald Trump will impose a 25% tariff on imported cars, trucks, and key auto components.

- CSB Bank's share price surged by 5.46% on Wednesday following the release of a robust business update for March, reporting year-on-year growth in both total deposits and gross advances.

- Tata Consumer Products Ltd.'s shares surged over 8% on Wednesday following an upgrade from Goldman Sachs. The brokerage raised its rating on Tata Consumer from Neutral to Buy and increased the target price to Rs 1,200 from Rs 1,040 per share.

CSB Bank Share Price Surges After Robust Business Update

- CSB Bank's share price surged by 5.46% following a robust business update for March.

- Total deposits of CSB Bank grew by 24% to Rs 36,861 crore, compared to last year.

- Gross advances of CSB Bank increased by 29.6% to reach Rs 31,843 crore.

- CSB Bank is a private sector bank offering a wide range of banking and financial services, headquartered in Thrissur, Kerala.

Stocks To Watch Today: Tata Motors, Swiggy, V-Mart Retail, CSB Bank, Dabur, JSW Energy

- Tata Motors, Hyundai Motor India, V-Mart Retail, CSB Bank, SJVN, JSW Energy are the stocks to watch before going into trade on Wednesday.

- Swiggy received a tax assessment order of Rs 158 crore from the Income Tax department.

- Dabur India received an assessment order of Rs 110 crore from the Income Tax department.

- Siemens appointed new executives, Sunil Mathur as chairperson, Guilherme Mendonca as MD & CEO, and Harish Shekar as CFO.

IDFC First, Bandhan, RBL, Ujjivan, Suryodhay et al: A decade of bank IPOs and how the search for the next HDFC Bank boomeranged

- Many banking stocks, including private banks and small finance banks (SFBs), have underperformed and failed to replicate the success of HDFC Bank.

- Out of all bank IPOs in the last decade, only a few, including AU SFB, CSB Bank, Equitas SFB, and Jana SFB, have posted positive returns since IPO.

- Most banking stocks have significantly lagged behind the Nifty Bank index, with only a few exceptions like Federal Bank.

- The top 5 banks, including HDFC Bank, SBI, ICICI Bank, Axis Bank, and Kotak Mahindra Bank, have dominated the banking sector and driven the index's growth.

Compare CSB Bank with

Contribute & help others!

Companies Similar to CSB Bank

CSB Bank FAQs

Reviews

Interviews

Salaries

Users